Social Security is a cornerstone of financial safety in the United States, administered by the Social Security Administration (SSA). Launched in 1935, it provides monthly cash benefits to retired or disabled workers and family members, as well as survivors of deceased workers. Most Americans contribute to Social Security through payroll taxes during their careers, building eligibility for future support. The program’s benefits reach over 69 million people, covering essential needs for diverse groups including seniors, disabled persons, widows, and children. Understanding how Social Security operates, what benefits are available, login steps and how to qualify empowers individuals to secure long-term economic stability.

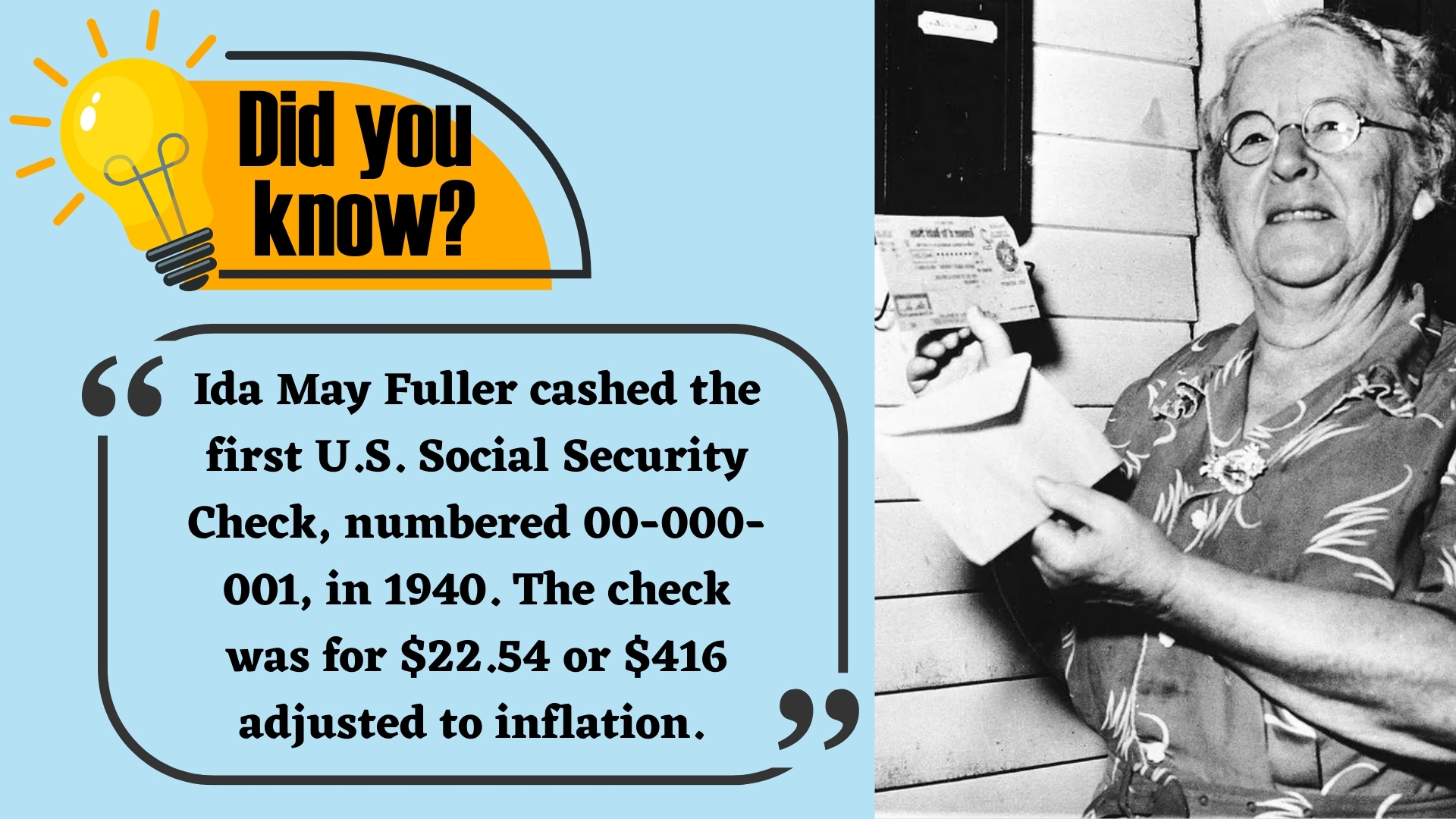

Did You Know?

According to SSA Gov., the first Social Security check was cashed by Ida May Fuller, a legal secretary from Vermont. On January 31, 1940, she received a monthly benefit of $22.54 after working under Social Security for nearly three years. Ida May Fuller became a symbol of the program’s success, living to 100 years and receiving $22,888.92 during her lifetime which was much more in benefits than she paid in taxes.

What is the U.S. Social Security?

The U.S. Social Security program is officially called the Old-Age, Survivors, and Disability Insurance (OASDI) system. It’s a federal initiative that provides regular cash payments to eligible workers, their families, and survivors, funded primarily by payroll taxes. Benefits cover:

-

Retirement support- these benefits are accesible and applicable for those aged 62 and older with enough work credits.

-

Disability income- disabled workers unable to work due to serious medical conditions can get these benefits applied to them.

-

Survivor benefits- these benefits are paid to spouses, children, or other dependents of deceased workers.

Additionally, the Supplemental Security Income (SSI) program serves aged and disabled people with limited resources, though it’s funded differently.

| Benefit Type | Who Qualifies | Key Features |

| Retirement | Workers 62+ with adequate credits | Based on earnings and age |

| Disability | Disabled workers with credits | Must be medically certified |

| Survivors | Families of deceased workers | Includes widows and children |

| SSI | Elderly/disabled, low-income | Strict financial need-based |

What Are the Main Benefit Types and Application Process?

U.S. Social Security 2025 pays monthly benefits for retirement, disability, and survivors. The application process can be completed online, by phone, or in person at SSA offices. Early or delayed applications affect the monthly amount received; careful planning is advised for maximizing benefits. SSI applicants must prove financial need, while disability cases require medical documentation.

Social Security Login Steps

Accessing your Social Security information online allows convenient management of benefits anytime, anywhere. The social security login process requires using secure credentials throughLogin.gov orID.me, replacing older username methods. Follow simple steps to set up or access your account safely.

- Visitwww.ssa.gov/myaccount.

- Click “Sign In or Create an Account.”

- ChooseLogin.gov orID.me as your sign-in method.

- Provide your email and verify it.

- Create a strong password (at least 12 characters).

- Set up two-factor authentication for added security.

- Enter your personal information (name, SSN, birthdate).

- Confirm details exactly as on your official documents.

- Complete account setup following the prompts.

- Use your new credentials to log in securely.

How Do You Qualify for Social Security Benefits?

Eligibility for most Social Security benefits requires work credits earned by paying Social Security taxes. A standard requirement is 40 credits, equivalent to about 10 years of work. SSI has separate needs-based criteria and does not rely on work history. Monthly benefit amounts are calculated from lifetime earnings, benefit type, and the claimant’s age at application.

Read Other U.S. News and Stories-

List of Top 10 U.S. Cities Where Retirees Can Live Well on Social Security

3 Social Security Misconceptions

What is the Social Security Retirement Age?

Conclusion

U.S. Social Security remains essential for millions, safeguarding financial stability for workers, families, and the vulnerable. By grasping the benefit types and eligibility rules, Americans gain the tools for sensible retirement and risk planning, ensuring dependable support when life’s challenges arise.

To see more of such stories, you can go ahead and add this site to your preferred sources by clicking here.

Comments

All Comments (0)

Join the conversation