The history of banking in the United States consists of periods of growth, crises, and regulatory reform. The story of banking in the United States can be traced from the first financial institution, the First Bank of the United States, established in the late 18th century, to some of the recent reforms reflected in the Dodd-Frank Act. Every period in the history of banking in the United States shows attempts to find a safe, stable, and resilient financial system.

Banking reform has largely been predicated on the economic environment, including panics, crises, and failures in the financial sector, to afford protection to depositors, to regulate financial institutions, and to ensure public confidence. Understanding banking reform provides context for understanding how the U.S. financial system has evolved over centuries, especially its responses to success and failure.

Check Out: Tropical Storm Erin 2025: Check Majorly Affected Places, Current Status and Forecast

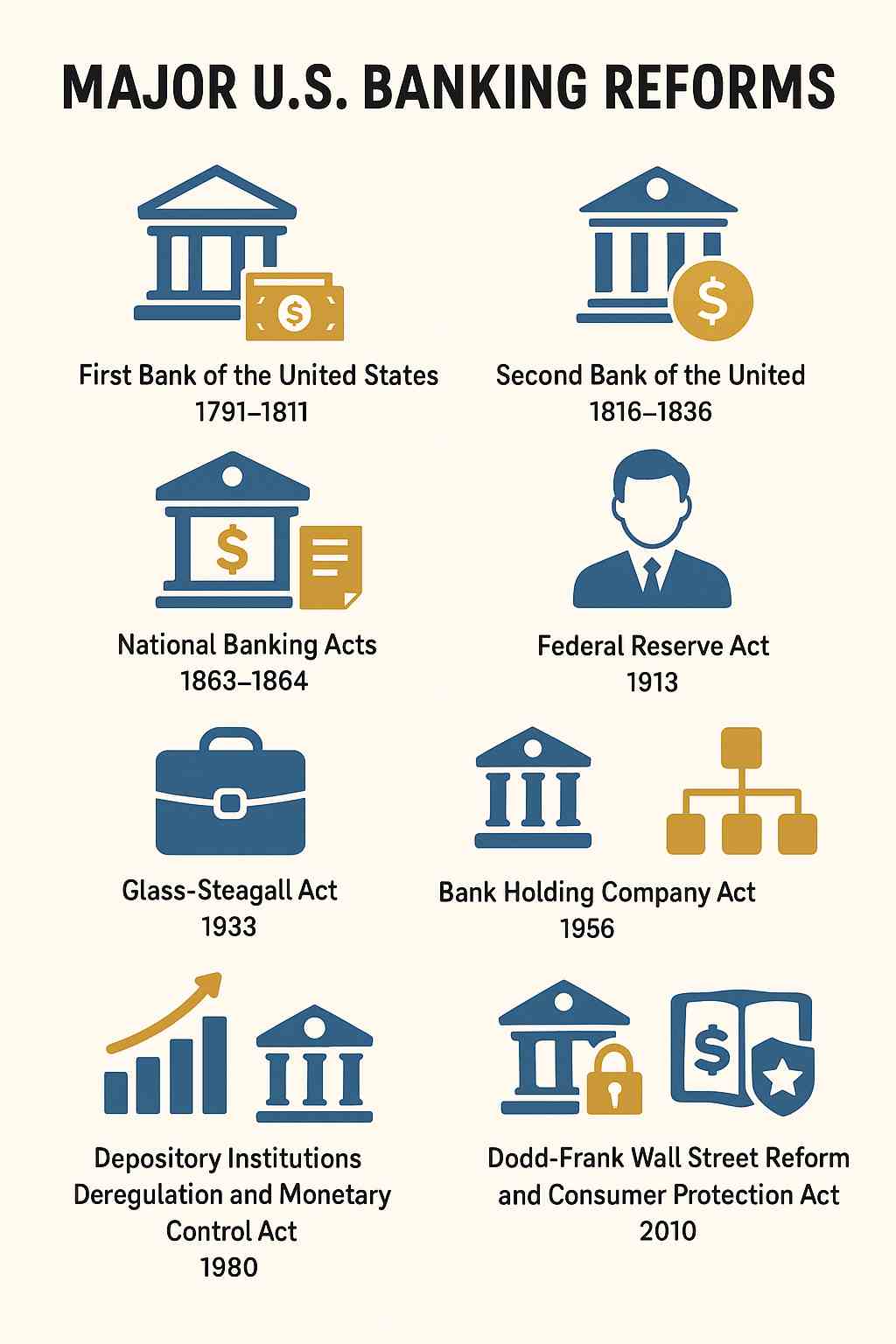

List of Top Banking Reforms in U.S. History

| No. | Banking Reform Name | Year/Period |

| 1 | First Bank of the United States | 1791–1811 |

| 2 | Second Bank of the United States | 1816–1836 |

| 3 | National Banking Acts | 1863–1864 |

| 4 | Federal Reserve Act | 1913 |

| 5 | Glass-Steagall Act | 1933 |

| 6 | Bank Holding Company Act | 1956 |

| 7 | Depository Institutions Deregulation and Monetary Control Act | 1980 |

| 8 | Gramm-Leach-Bliley Act | 1999 |

| 9 | Dodd-Frank Wall Street Reform and Consumer Protection Act | 2010 |

Top 8 Major U.S. Banking Reforms Through History

The banking system in the United States has experienced a dynamic evolution, often as a result of financial crises, economic shifts, and the need to protect depositors and maintain stability. Banking reform in the U.S. has stemmed from lessons learned from failures and from building a resilient financial system. This information has been curated based on data from U.S. Government Publishing Office (GPO)

1. The First and Second Banks of the United States (1791–1836)

The origins of U.S. banking reform can be traced to the First Bank of the United States, which was established in 1791. proposed by Alexander Hamilton, it had a goal of providing surety to the young country and the economy, managing debts engendered by the Revolutionary War, and offering a uniform currency.

It expired in 1811, and the Second Bank was created to deal with the same issues in 1816. Both of the banks faced resistance because opponents claimed that too much power resided with a centralized bank, and these involved the ongoing challenges with the coordination between the federal government and state banks in the early period of U.S. history.

2. National Banking Acts (1863–1864)

During the Civil War, the federal government worked to fund military expenses while simultaneously trying to put the currency back into a single style. The National Banking Acts introduced federally audited banks, a national currency, and a system of oversight of the banks. This improvement solidified the federal government's role in banking, and led to the nation's modern banking regulation.

3. The Federal Reserve Act (1913)

After a number of bank panics, most notably Panic of 1907, the Federal Reserve Act established the Federal Reserve System as the central bank of the United States. Its focus was to provide a safer, more flexible, and more stable monetary and financial system. The Fed gained authority over interest rates, reserve requirements, and supervision of member banks, which was a significant advancement in regulation of banking at the national level.

4. The Glass-Steagall Act (1933)

The Great Depression revealed serious deficiencies in the banking system. In response, the Glass-Steagall Act created a bright line separating commercial banking from investment banking to avoid conflict of interest. The FDIC (Federal Deposit Insurance Corporation) also was created to insure deposits and restore public trust in the banking system.

5. The Bank Holding Company Act (1956)

This act regulated the growth of bank holding companies and limited their capacity to engage in non-banking activities, in order to ensure banking services remained concentrated and focused on the banking function.

6. The Depository Institutions Deregulation and Monetary Control Act (1980)

In response to non-bank financial institutions increasingly competing with banks, this legislation aimed to deregulate interest rates while also providing banks with increased leeway. The legislation helped banks offer more options and products to their customers while retaining oversight and regulation on the costs of the products, thus beginning modern financial deregulation.

7. The Gramm-Leach-Bliley Act (1999)

While repealing portions of Glass-Steagall, the Gramm-Leach-Bliley Act permitted consolidation among commercial banks, investment banks, and insurance agencies so they could provide multiple services as a single financial institution. It was the beginning of change regarding the recognition of a new dynamic in the global financial landscape. The law was also part of a continuing conversation regarding risk management, as had been developed during federal consideration of risk management following the 2008 financial crisis.

8. The Dodd-Frank Wall Street Reform and Consumer Protection Act (2010)

The Dodd-Frank law was established in the aftermath of the financial slump broadly known as the financial crisis in early 2008. Dodd-Frank acted to stabilize and reduce the overall risks to the banking system and to consumers using various banking and non-bank services available in the banking system.

Dodd-Frank established the Consumer Financial Protection Bureau (CFPB) and established increased regulatory scrutiny and mechanisms for regulating derivatives, leverage, and large-scale financial institutions deemed "too big to fail." The passage of Dodd-Frank marked one of the most comprehensive reforms of banking regulation to be enacted in the history of regulating banks in the United States.

Conclusion

Banking reform in the U.S. has been historically reactionary, coming from crises, and now the cycle of reacting, regulating, and adjusting to those regulations will continue. As we see from the history previously recounted, U.S. banking reform has included the creation and adaptation of a public and banking system that regulates the balance between stability, economic growth, and the public's trust. The historical aspect of the U.S. banking and financial systems remains relevant to understanding public trust and the complexities in attempting to regulate an ever-evolving financial and banking system.

Comments

All Comments (0)

Join the conversation