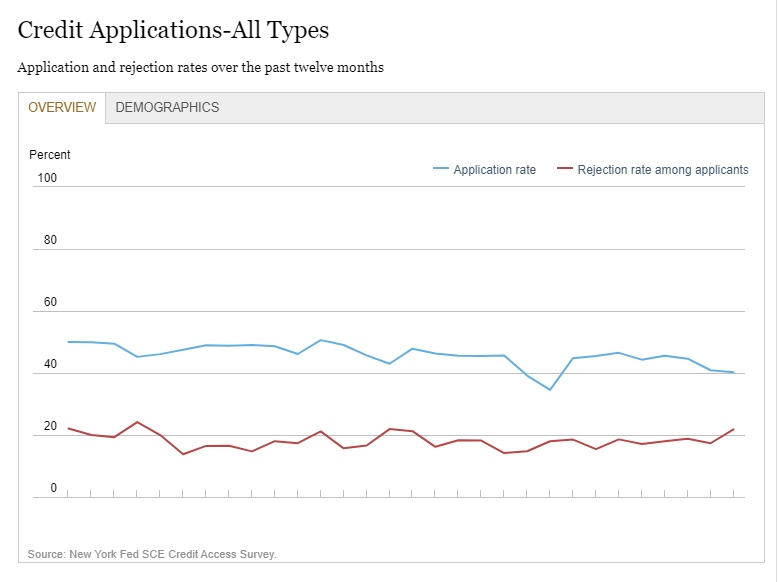

More and more Americans have been turning to loans to make ends meet but it hasn’t been easy. The number of loan rejections has increased continuously over the years and recently it hit a record high in the last 5 years according to a report by the New York Federal Reserve.

The report found that the overall rejection rate for credit applicants reached 21.8% in 2023, the highest since 2018. The report also found that the majority of rejections were for people with credit scores under 680.

Source: Federal Reserve Bank of New York

New York Federal Reserve mentions, “The overall rejection rate for credit applicants increased to 21.8 percent, the highest level since June 2018. The increase was broad-based across age groups and highest among those with credit scores below 680.”

The Survey of Consumer Expectations (SCE) Credit Access Survey is a rotating module of the SCE that is conducted every four months. The data from the survey is uploaded online three times every year to report on the credit situation in the United States.

There are a number of reasons for this trend. One factor is the rising cost of living. As the cost of housing, food, and other essentials has gone up, more people are finding themselves struggling to make their payments.

This can lead to a decline in credit scores, which can make it more difficult to qualify for a loan.

Another factor is the tightening of lending standards. Banks have become more cautious about lending money. This has made it more difficult for people with less-than-perfect credit to qualify for a loan.

What Categories of Loans Are Getting Rejected?

Auto loans took a major hit in rejection rates, with 14.2% of applications being denied in 2023, up from 9.1% in February 2023. This was followed by credit cards (credit cards (21.5%), credit card limit increase requests (30.7%), mortgages (13.2%), and mortgage refinance applications (20.8%).

Source: Federal Reserve Bank of New York

The report mentions “The rejection rate for auto loans increased to 14.2 percent from 9.1 percent in February, a new series high. It increased for credit cards, credit card limit increase requests, mortgages, and mortgage refinance applications to 21.5 percent, 30.7 percent, 13.2 percent, and 20.8 percent, respectively.”

In addition to the rising rejection rates for loans, the report also mentions a trend of people diverting away from loans and applying for credit cards.

It revealed that the number of respondents who are planning to apply for one or more credit cards over the next 12 months increased to 26.4% from 26.1% in February.

Further, this is what the report mentions: “The average reported probability that a loan application will be rejected increased sharply for all loan types. It rose to 30.7 percent for auto loans, 32.8 percent for credit cards, 42.4 percent for credit limit increase requests, 46.1 percent for mortgages, and 29.6 percent for mortgage refinance applications. The readings for auto loans, mortgages, and credit card limit increase requests are all new series highs.”

Comments

All Comments (0)

Join the conversation