The United States has been facing increased fear due to a possible debt-ceiling economic crisis that could occur in the first week of June 2023. Here is everything you need to know about its impact on the world economy.

What is US Debt Ceiling

The US debt ceiling is the maximum amount that the US government is allowed to borrow so that it can meet its financial obligations. The debt ceiling was created in 1917 so that Congress could control government spending. However, it has become a political issue in recent years.

The US Department of the Treasury states “The debt limit is the total amount of money that the United States government is authorized to borrow to meet its existing legal obligations, including Social Security and Medicare benefits, military salaries, interest on the national debt, tax refunds, and other payments.”

The US national debt is constantly increasing as almost every year, the government spends more than the amount it collects in taxes and that is the deficit amount. So, to pay this amount the government borrows money.

According to the US Treasury Fiscal Data “The national debt is the amount of money the federal government has borrowed to cover the outstanding balance of expenses incurred over time.

“In a given fiscal year (FY), when spending (ex. money for roadways) exceeds revenue (ex. money from federal income tax), a budget deficit results.

“To pay for this deficit, the federal government borrows money by selling marketable securities such as Treasury bonds, bills, notes, floating rate notes, and Treasury inflation-protected securities (TIPS).”

How much debt does the US owe?

Since the establishment of the debt ceiling the US government has been borrowing significantly more and the debt ceiling has been continuously changing.

According to the US Department of the Treasury, “Since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit – 49 times under Republican presidents and 29 times under Democratic presidents.”

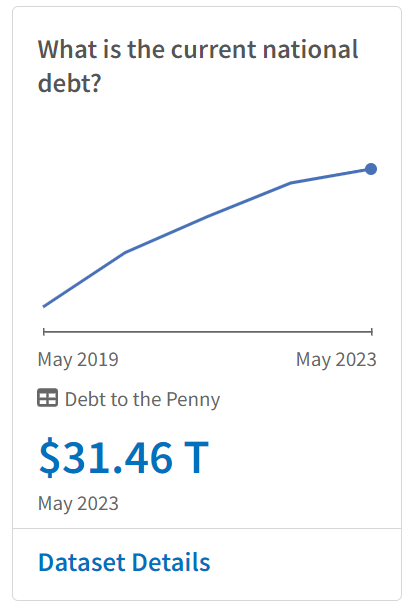

The current US debt ceiling is $31.4 trillion. The US government hit the debt ceiling on January 19, 2023. If Congress does not raise the debt ceiling, the US government will be unable to pay its bills and will default on its debt.

Source: U.S. Treasury Fiscal Data

According to the official letter by Secretary of the Treasury Janet Yellen, “I am writing to inform you that beginning on Thursday, January 19, 2023, the outstanding debt of the United States is projected to reach the statutory limit.

“Once the limit is reached, Treasury will need to start taking certain extraordinary measures to prevent the United States from defaulting on its obligations.”

Impact on the World economy

President Joe Biden is not planning to increase the debt limit and is set to take measures to rectify the situation. In the recent talk with the speaker Kevin McCarthy, Joe stated “But I think we both agree that we need to change trajectory, that our debt is too large.

“And I think, at the end of the day, we can find common ground, make our economy stronger, take care of this debt, but, more importantly, get this government moving again to curb inflation, make us less dependent upon China, and make our appropriations system work when we get done, right?”

A default would have a devastating impact on the US economy, causing interest rates to rise, stock prices to fall, and the value of the dollar to decline.

According to the White House written materials “defaulting on our government’s debt could reverse the historic economic gains that have been achieved since the president took office.”

Mark Zundi chief economist at Moody's Analytics says, “No corner of the global economy will be spared,”

According to Moody’s Analytics “Given the dramatic reduction in government spending in this scenario and the already fragile economy, the economy suffers a recession in 2024, costing the economy 2.6 million jobs at the worst of the downturn and pushing unemployment to a peak of near 6%.”

Comments

All Comments (0)

Join the conversation