If you want to borrow some money or want a credit card then the chances of your application being successful depends on your CIBIL score. CIBIL score is among the first things that the lenders check to determine whether they can hand you the money, and the extent of risk that they are taking. It is very crucial in determining your financial prospects in India. Here is a detailed explanation on what is the CIBIL score, how the score is determined, its importance, factors that determine it, and how to improve or sustain the score.

What is CIBIL Score?

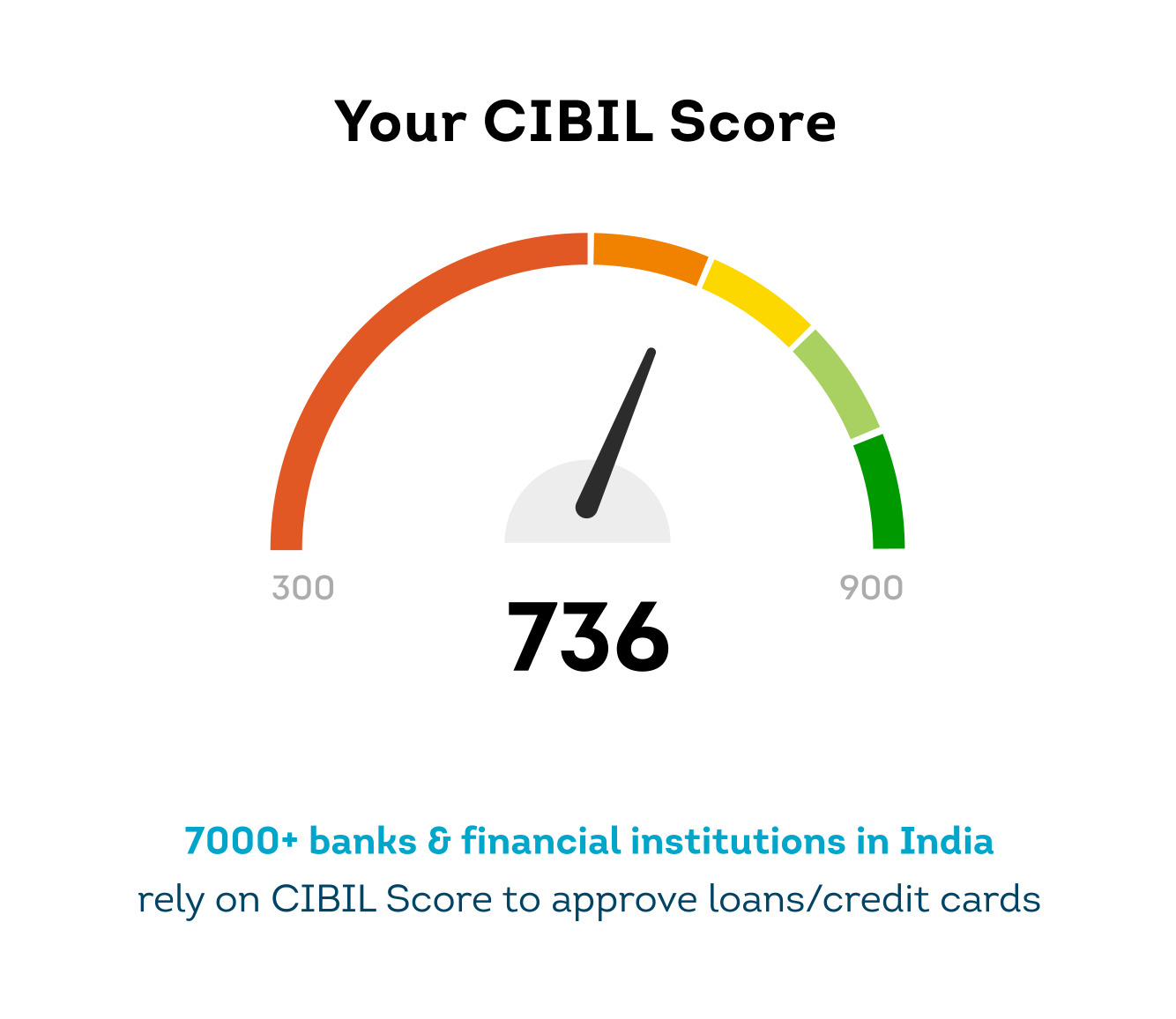

Source: TransUnion CIBIL

CIBIL Score (Credit Information Bureau (India) Limited) is a three-digit figure which indicates your creditworthiness in accordance with your credit history. Transunion CIBIL slates the score as ranging between 300 and 900 and the higher your score is to 900, the better may be the perceptions of those who will be lending to you.

The CIBIL website mentions, “Your CIBIL Score is a 3-digit numeric summary of your credit history that indicates your creditworthiness and demonstrates your ability to repay a loan. CIBIL score ranges from 300 to 900. The closer your score is to 900, the higher are the chances of you getting your loan /credit card.”

This score is obtained based on the information on your Credit Information Report (CIR) and it is particularly available in the accounts and enquiries section, which are furnished by banks and other financial institutions. The company, which keeps this system and gives the score, is TransUnion CIBIL (previously known as Credit Information Bureau (India) Limited).

How is CIBIL Score Calculated?

According to the CIBIL website, there are four significant factors that are considered to calculate your score: payment history, credit utilisation, age and mix of credit, and credit enquiries.

Payment History

-

This is the consistency with which you pay the loans, credit cards, EMIs, etc.

-

Late or defaults of payment are strongly negatively affected.

Credit Utilisation

-

This is a ratio of the amount of your credit you are utilizing.

-

Having a high utilisation (i. e. use a big part of your credit limit) implies that you might be over-leveraged, which is bad to your score.

Age and Credit Mix

-

Age of Credit: Age of your credit accounts (cards, loans). A longer history is preferable.

-

Mix of credit: What combination of credit you have, e.g. combination of secured (home and auto) and unsecured credit (credit card, personal loan) makes your profile stronger.

Credit Enquiries

-

These are the checks done by the lender when you apply for a new credit.

-

Excessive hard inquiries (i.e applications to obtain credit) within a short time frame can reduce your score, as this is an indication of increased risk.

Why Is CIBIL Score Important?

-

First Screening of the Lenders: Lenders use the CIBIL score as an efficient and fast means of determining how risky it is to lend to you.

-

Impacts Loan Decisions: The higher your CIBIL score the more likely to be approved of your loan or credit card application.

-

Improved Loan Conditions: A high score will ensure that you are given better rates or better terms of a loan.

-

Credit Confidence: When the score is good, it is an indication to the lenders that you handle credit effectively. It makes them have more confidence in lending to you.

What are the Factors Influencing CIBIL Score?

The key aspects, which determine your CIBIL score, include:

-

Payment History-- The quality of your payments on time and in full.

-

Credit Utilisation-- The extent to which you are utilising credit relative to your limit.

-

Age and Mix of credit - how long you have had credit and the balance in a type of credit you have (secured and unsecured).

-

Credit Enquiries -- This refers to how many times lenders have examined your credit in the course of applying to receive new credit.

-

And one more condition: in case of a very small amount of credit history, your report can be either NH (No History) or NA (Not Available) and in this case, CIBIL simply lacks enough information to credit you with an actual score yet.

How to Maintain or Improve CIBIL Score?

The following are the steps that you can take to create a healthy CIBIL score or sustain it according to TransUnion CIBIL website:

-

Pay on Time: ensure that you pay all your EMIs and credit card bills as well as loan payments on time. Late or default payments destroy your credit score.

-

Use the Credit Sparingly: Make an attempt not to use all of the available credit. It is very important to maintain a low credit utilisation.

-

Keep Old Accounts Open: Old accounts that have been in good standing should not be closed in case you have credit accounts that have been open for a long time they will assist in boosting your credit history.

-

Not too many credit applications: Only apply to new credit when necessary. You can lose points through frequent applications and hard enquiries.

-

Periodically Check Your Report: Check your CIBIL report against errors or entries that you have no knowledge about and dispute in writing in case of an error.

In conclusion, the CIBIL score is a strong instrument that is used to show the extent to which you use credit responsibly. It is not a mere figure as it informs the lenders of your financial behaviour since they trust you or not. The first step to take when seeking to improve or sustain your credit health is to understand how the score is computed and what factors have an impact on this score such as payment history, credit usage and enquiries. This not only increases your odds with the lenders but also gives you better financial security and assurance when you borrow.

Comments

All Comments (0)

Join the conversation