BSEH Haryana Board Class 12 Accountancy Model Paper 2025: The Board of School Education Haryana (BSEH) is responsible for the administration and development of school education in Haryana. It has made available the latest model test papers for almost all the subjects for class 12 students. Students can check the sample papers on bseh.org.in. These model test papers are important for students who will be appearing in the 2025 examination. We have covered the HBSE Class 12 Accountancy Model Paper and Marking Scheme here.

Students can check the marking scheme given along with the sample question paper. You will get insights into the question paper pattern and type of questions for the examination. Solving the model test papers will help students to perform well and boost their confidence.

Also Check: HBSE Class 12 Syllabus 2024-25 (All Subjects)

Continue reading to download the HBSE Class 12 Accountancy Model Paper and Marking Scheme in pdf format from direct links in this article.

HBSE Class 12 Accountancy Question Paper Instructions 2024-25

1. This question paper comprises two parts A and B . There are 30 questions in the question paper. All questions are compulsory.

2. Part A is Compulsory for all candidates.

3. Part B has two options i.e. (1) Analysis of Financial Statements and (2) computerized Accounting. You have to attempt only one of the given options.

4. Question Nos. 1 to 10 and 23-27 are very short answer type questions carrying 1 mark each. Question Nos. 11-15 and 28 are questions carrying 2 marks each.

5. Question Nos. 16 to 20 and 29 are questions carrying 3 marks each.

6. Question Nos. 21, 22 and 30 are questions carrying 5 marks each.

7. An internal choice is available in some questions. You have to attempt only one of the given choices in such questions.

HBSE Class 12 Accountancy Model Paper 2024-25

Given below are the questions from HBSE Class 12 Accountancy Model Paper 2024-25.

Part-A (Accounting for Partnership Firms and Companies)

Q1. In the absence of Partnership Deed, the interest is allowed on partner’s Capital:

A) 6% P.a.

B) 10% P.a.

C) 12% P.a.

D) No interest is allowed

Q2. When a partner is given guarantee by other partners, loss on such guarantee will be born by:

A) Partnership firm

B) All the other partners

C) Partners who give the guarantee

D) Partner with highest profit sharing ratio.

Q3. On the death of a Partner, the amount due to him will be created to :

A) All partner’s Capital Account

B) Remaining Partners Capital Account

C) His executor’s Account

D) Government’s Revenue Account

Q4. On dissolution of a firm, debtors were Rs. 17,000. Of these Rs. 500 became bad and the rest realized 60 % Which account will be debited and by how much amount?

A) Realization Account by Rs. 16500

B) Profit and Loss Account by Rs. 7100

C) Cash Account by Rs. 9900

D) Debtors Account by Rs. 7100

Q5. Maximum number of members of a Private Company is ……….As per Company Act 2013.

Q6. Given below are two Statements, one labelled as Assertion (A) and the other labeled as Reason (R) :

Assertion (A) : If there are Eight Partners in a firm, a new partner cannot be admitted even if one partner does not agree to this.

Reason (R) : A new partner can be admitted if majority of partners agree on his admission.

Also Check: HBSE Class 12 Model Papers 2024-25 (All Subject PDFs)

In the context of the above two statements, which of the following is correct?

Codes:

A) (A) and (R) both are correct and (R) correctly explains (A).

B) Both (A) and (R) are correct but (R) does not explain (A).

C) Both (A) and (R) are incorrect.

D) (A) is correct but (R) is incorrect.

Q7. What do you understand by Sweat Equity Shares?

Q8. What is coupon rate?

Q9. On the basis of given Statement: Assertion (A) and Reason (R), Choose the correct option:

Assertion (A): Dissolution of partnership firm refers to the dissolution of the Partnership among all the partners of the firm.

Reason (R) : Dissolution of partnership firm results into closure of business and hence dissolution of partnership also.

Option:

A) (A) and (R) are true, but (R) is not correct explanation of (A).

B) Both (A) and (R) are true and (R) is correct explanation of (A).

C) Both (A) and (R) are false.

D) (A) is false, but (R) is true.

Q10. There was an Unrecorded Assets of Rs. 2000 which was taken over by a partner at Rs. 1500. Partner’s Capital Account will be debited by ………

Q11. A, B and C are partners in a firm. They have omitted interest on Capital @ 10% P.a. for year ended 31st March, 2024. Their capitals were Rs. 1,00,000, 80,000 and Rs. 70,000 . Pass an adjustment entry.

OR

Mention two items that may appear on the credit side of a Partner’s Fixed Capital Account.

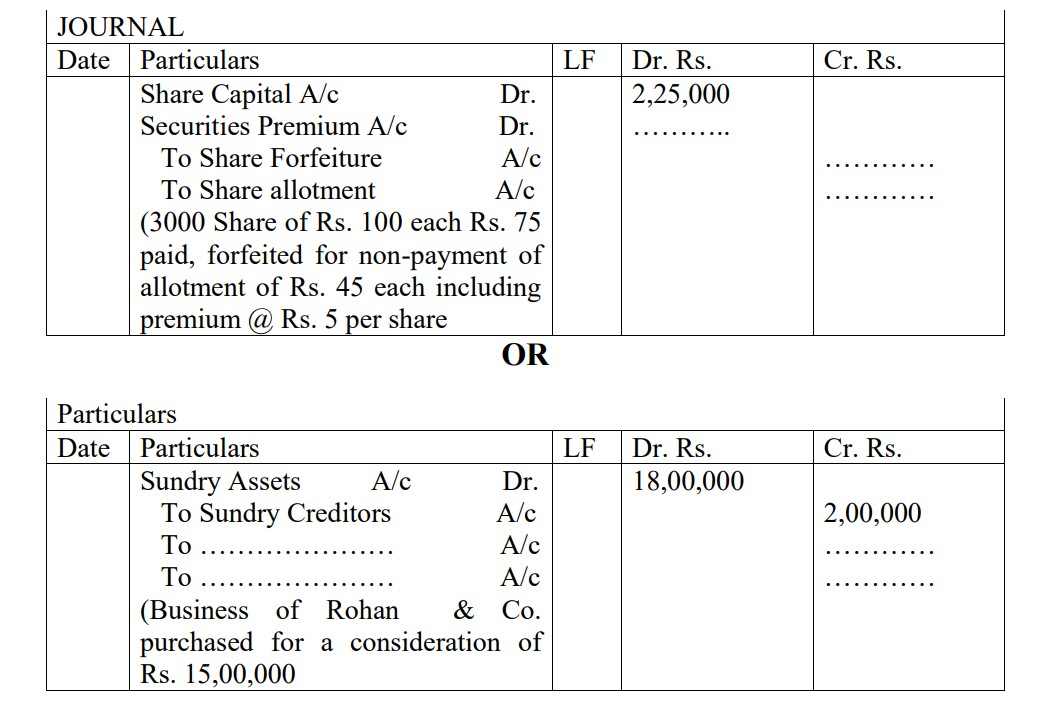

Q12. Complete the following journal entry by filling the blanks:-

Q13. A and B are partners. They admit ‘C’ for ¼ th Share. In future the ratio between A and B would be 2:1 Find out New Ratio.

Q14. Name any two factors affecting goodwill of a Partnership Firm.

Q15. Distinguish between Average Profit and Super Profit with two points.

Q16. State any three purposes for which securities Premium can be utilized.

Q17. A and B are partners in a firm. A is entitled to a salary of Rs. 15000 P.m. and a commission of 10% of net profit before charging any commission. B is entitled to a commission of 10% of net profit after charging his commission. Net Profit for the year ended 31st March 2024 was Rs. 4, 40,000. You are required to show the distribution of Profit.

Q18. Give a comparison of Sacrificing Ratio and Gaining Ratio.

Q19. Write any three, points of differences between dissolution of Partnership and Dissolution of Partnership firm.

Q20. Explain the meaning of the following terms.

1. Capital Reserve.

2. Reserve Capital

3. Issue of Debentures as collateral Security

OR

Bata Ltd. Issued 5,000, 9% Debenture of Rs. 500 each pass the necessary Journal entries for the issue of Debentures in the books of the company in the following cases.

i) When debentures are issued at par and redeemable at Par.

ii) When debentures are issued at 5% Premium and redeemable at 10% Premium.

iii)When dentures are issued at a premium of 25% to the vendors for machinery purchased for Rs. 6,25,000.

Q21. Differentiate between a share and a debenture.

OR

Sangeeta Ltd. Invited applications for issuing 60,000 Shares of Rs. 10 each at par. The amount was payable as follows:

On Application Rs. 2 per Share

On Allotment Rs. 3 per Share

On First Final call Rs. 5 per Share

Application were received for 92,000 Shares. Allotment was made on the following basis :

i) To applicant for 40,000 shares- Full

ii) To applicant for 50,000 shares- 40%

iii)To applicant for 2,000 shares- NIL

Rs. 108000 was realized on account of allotment (excluding the amount carried from application money) and Rs. 2,50,000 on account of call.

The directors decided to forfeit shares of those applicants to whom full allotment was made and on which allotment money was overdue.

Pass Journal entries in the books of Sangeeta Ltd. To record the above transactions.

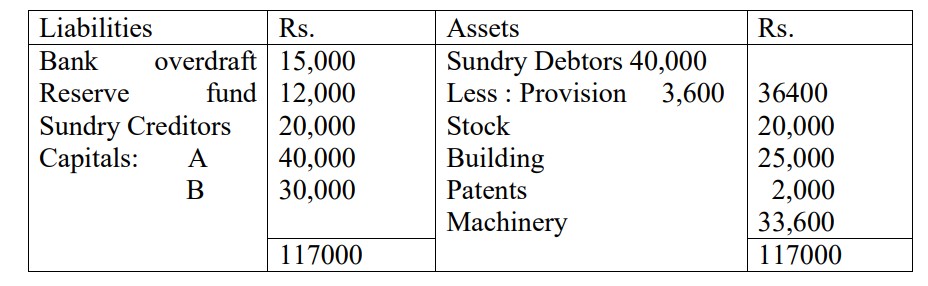

Q22. The following is the Balance sheet of A & B as at 31st March, 2022 who share profit in the ratio of 2:1.

They admitted C into Partnership on 1st April 2022. New profit sharing ratio is agreed as 3/6 , 2/6 : 1/6 . C brings in proportionate Capital after the following adjustments:

(1) C brings in Rs. 10,000 in cash as his share of good will

(2) Provision for doubtful debts is to be reduced by Rs. 2,000.

(3) There is an old typewriter valued Rs. 2600. It does not appear in the books of the firm. It is now to be recorded.

(4) Patents are valueless.

(5) 2% discount is to be received from creditors Prepare Revaluation A/c, Capital A/cs and the opening Balance Sheet.

OR

Explain the accounting treatment of Goodwill with imaginary figures at the time of retirement of a Partner from the firm.

To get the complete sample paper and marking scheme, refer to the links given below:

| Download HBSE Class 12 Accountancy Marking Scheme 2024-25 PDF |

Tips to Prepare for HBSE Class 12 Accountancy Examination

1. Students must first familiarize themselves with the syllabus so as to understand which topics carry more weightage. Ensure that you prepare according to the latest syllabus only.

2. Accountancy is a subject that demands regular practice. It is important that students practice as much as they can. Practice the questions given at the end of each chapter.

3. Students give time to all topics on the basis of their strengths and weaknesses. Don’t let your bias towards your favourite chapter affect the time-table. Make time for revision.

4. Solve the problems from Class 12 subject textbook to clear the concepts and strengthen understanding. While solving problems, students should make it a habit to point down points where you get stuck.

5. Solve a number of previous year question papers and give mock tests to get insights into the type and level of difficulty of questions. Solving these will help to increase the speed of students. to check your level of preparedness. Pay attention to the questions that are repeatedly asked every year.

Also, check

CBSE Class 12 Syllabus 2024-25 Download PDF

NCERT Class 12 Revised Textbooks

CBSE Class 12 Study Plan for 2025 Exam

CBSE Class 12 Competency Based Questions 2024-25 PDFs

Comments

All Comments (0)

Join the conversation