The 7th Pay Commission was established by the Indian government to revise salaries, allowances, and pensions for central government employees, effective January 1, 2016.

As the 7th Pay Commission completes its 10-year term, discussions about the 8th Pay Commission have gained momentum.

Although not officially formed yet, it's expected to review and recommend salary and pension reforms for government employees, potentially taking effect in January 2026.

In this article, we'll explore the key differences between the 7th and 8th Pay Commissions and how they impact government employees.

Check Out| 8th Pay Commission: सरकारी कर्मचारियों को मिली बड़ी खुशखबरी, 8वें वेतन आयोग से अब होगी इतनी सैलरी

Overview of the 7th and 8th Pay Commissions: What They Aim to Achieve

Both the 7th and 8th Pay Commissions play crucial roles in adjusting government employee salaries in India.

7th Pay Commission

The 7th CPC established a foundation for modernising pay structures through a new pay matrix and substantial salary boosts.

Establishment and Purpose

The 7th Central Pay Commission (CPC) was established on February 28, 2014, under the chairmanship of Justice Ashok Kumar Mathur.

Its primary objective was to review and recommend changes to the pay structure of central government employees, including those in various services such as All India Services, Union Territories, and the Defence Forces.

The Commission aimed to ensure that salaries were aligned with current economic conditions, inflation rates, and the cost of living.

Key Recommendations

- Minimum Pay Increase: Based on the Aykroyd formula, the minimum pay for new recruits was set at ₹18,000, a significant increase from ₹7,000 under the previous commission.

- Maximum pay: Rs 225,000 per month for the Apex Scale and Rs 250,000 per month for Cabinet Secretary and others at the same pay level.

- Pay Matrix: The introduction of a new pay matrix simplified salary structures by providing a clear framework for salary progression across different levels of employment.

- Pensions: The pension for retired officials was increased by approximately 23.66%, ensuring better financial security for retirees.

- Gratuity: The 7th Pay Commission proposed raising the gratuity ceiling from ₹10 lakh to ₹20 lakh. Additionally, they recommend that this limit should increase by 25% whenever the Dearness Allowance (DA) surpasses 50%.

- House Rent Allowance (HRA): To align with the rise in basic pay for government employees, the Commission suggests increasing the House Rent Allowance (HRA) by 24%.

Furthermore, HRA will adjust to 27%, 18%, and 9% when the DA crosses the 50% mark. Once the DA exceeds 100%, HRA will increase further, reaching 30%, 20%, and 10%, respectively.

- Dearness Allowance (DA): The Dearness Allowance saw a 2% hike, bringing significant relief to government employees.

This adjustment, approved by the Union Cabinet, benefits over 50 lakh Central Government employees and nearly 55 lakh pensioners. The hike was implemented to address inflationary pressures, increasing the DA from 5% to 7%.

- Annual Increment: The annual increment rate of 3% per annum has been retained, as suggested by the Commission.

- Central Government Employees Group Insurance Scheme (CGEGIS): The Commission has recommended updates to the Central Government Employees Group Insurance Scheme, proposing revised rates to better meet employees' needs.

| Level of Employee | Present Monthly Deduction (₹) | Present Insurance Amount (₹) | Recommended Monthly Deduction (₹) | Recommended Insurance Amount (₹) |

| 10 and above | 120 | 1,20,000 | 5,000 | 50,00,000 |

| 6 to 9 | 60 | 60,000 | 2,500 | 25,00,000 |

| 1 to 5 | 30 | 30,000 | 1,500 | 15,00,000 |

The recommendations from the 7th Pay Commission were implemented on January 1, 2016, and have since significantly impacted the financial landscape for central government employees and pensioners.

For You| What is 7th Pay Commission of India?

8th Pay Commission

The upcoming 8th CPC aims to enhance these advancements by tackling current economic issues and bolstering financial stability for both government employees and retirees.

Formation and Goals

The decision to establish the 8th Pay Commission was announced on January 16, 2025. It aims to revise salaries and pensions for central government employees in light of changing economic conditions and inflationary pressures.

The Commission is expected to start functioning on January 1, 2026. However, it is not officially formed yet.It's expected to review and recommend salary and pension reforms for government employees.

Expected Changes and Benefits

- Fitment Factor: It is proposed that the Fitment Factor be set at 2.28, which would lead to a substantial increase in minimum wages—from ₹18,000 to ₹41,000—representing a potential rise of approximately 34.1%.

- Dearness Allowance: The DA is anticipated to reach around 70% by January 2026, further enhancing employee salaries.

- Impact on Employees: The changes could benefit approximately 67.85 lakh pensioners and around 48.62 lakh workers by improving their financial stability and living standards through an expected salary hike of between 25% and 35%.

Main Goals of the 8th Pay Commission

- Salary Revision: The Commission is expected to revise the basic salaries of central government employees, with anticipated increases ranging from 20% to 35%. This adjustment aims to reflect current economic conditions and inflation rates.

- Pension Enhancements: Retirees may see their pensions increase by up to 30%, improving their financial stability in retirement.

- Standardisation of Pay Structures: The 8th Pay Commission intends to eliminate disparities in salaries among different groups of employees. This includes standardising the Fitment Factor, which is crucial for determining salary increases across various levels.

- Adjustment of Allowances: Allowances such as house rent and travel allowances will be revised to align with current living costs, ensuring that employees can maintain a reasonable standard of living amidst rising expenses.

- Increased Minimum Wage: The minimum wage is projected to rise significantly, potentially increasing from ₹18,000 to around ₹41,000, thereby enhancing the purchasing power of employees at the lower end of the pay scale.

- Economic Impact: By increasing salaries and pensions, the 8th Pay Commission aims to boost disposable income for government employees and retirees, which could stimulate overall economic growth through increased consumer spending.

Key Differences Between the 7th and 8th Pay Commissions: Salary, Allowances, and Benefits

#WATCH | Delhi: Union Minister Ashwini Vaishnaw says, "Prime Minister has approved the 8th Central Pay Commission for all employees of Central Government..." pic.twitter.com/lrVUD25hFu

— ANI (@ANI) January 16, 2025

The 7th Pay Commission was implemented on January 1, 2016, while the 8th Pay Commission is expected to come into effect on January 1, 2026. Here are the primary differences regarding salary, allowances, and benefits:

Salary Structure

Minimum Salary:

- 7th Pay Commission: Established a minimum salary of ₹18,000 per month.

- 8th Pay Commission: Proposes an increase to a minimum salary of approximately ₹41,000, with some reports suggesting it could rise to ₹51,480 depending on the fitment factor.

Fitment Factor:

- 7th Pay Commission: Utilised a fitment factor ranging from 2.57 to 2.81, depending on the pay level.

- 8th Pay Commission: Expected to standardise the fitment factor at around 2.28, which translates to a significant salary increase across various levels.

Salary Increase Percentage:

- 7th Pay Commission: Resulted in an overall salary increase of about 14.29%.

- 8th Pay Commission: Anticipates a salary hike between 20% and 35%, with some estimates indicating a potential increase of up to 186% for minimum salaries if the fitment factor is set higher.

Allowances

Dearness Allowance (DA):

- 7th Pay Commission: The DA was revised periodically but did not reach as high as expected in subsequent years.

- 8th Pay Commission: DA is projected to increase significantly, potentially reaching around 70% by January 2026, which will be included in the base salary calculation.

Other Allowances:

- 7th Pay Commission: Rationalised various allowances like House Rent Allowance (HRA) and Transport Allowance (TA).

- 8th Pay Commission: Expected to further revise these allowances to better reflect current living costs and inflation pressures.

Benefits

Pension Structure:

- 7th Pay Commission: Set a minimum pension of ₹9,000 per month with adjustments for inflation.

- 8th Pay Commission: Pensions are expected to increase by up to 30%, with some estimates suggesting that pensions could also rise significantly based on the new fitment factor.

Gratuity and Other Benefits:

The 7th Pay Commission increased the gratuity ceiling to ₹20 lakh. The specifics for the 8th Pay Commission regarding gratuity have yet to be defined but are expected to follow similar trends of improvement.

Summary Table

| Feature | 7th Pay Commission | 8th Pay Commission (Expected) |

| Implementation Date | January 1, 2016 | Expected on January 1, 2026 |

| Minimum Salary | ₹18,000 | ₹41,000 (up to ₹51,480) |

| Fitment Factor | Multiple factors (2.57 to 2.81) | Proposed single factor of 2.28 |

| Salary Increase | Approximately 14.29% | Projected between 20% to 35% |

| Dearness Allowance | Periodic revisions | Expected to enhance retirement benefits by up to 30% |

| Minimum Pension | ₹9,000 | Up to ~30% increase |

| Gratuity Ceiling | ₹20 lakh | To be defined |

| Economic Considerations | Focused on inflation and economic growth | Comprehensive consideration of inflation, market prices, and employee expectations |

| Consultation Process | Engaged with stakeholders but faced criticism | Plans for extensive consultations with unions and governments |

| Overall Impact | Aimed to improve financial stability but limited flexibility in salary structures | Designed to address pressing economic conditions with potentially greater benefits for employees |

In Case You Missed| 8th Pay Commission News: What will be the Expected Salary of Central Govt. Employees? Check Details Here

Impact of the 8th Pay Commission on Government Employees: What to Expect in 2026

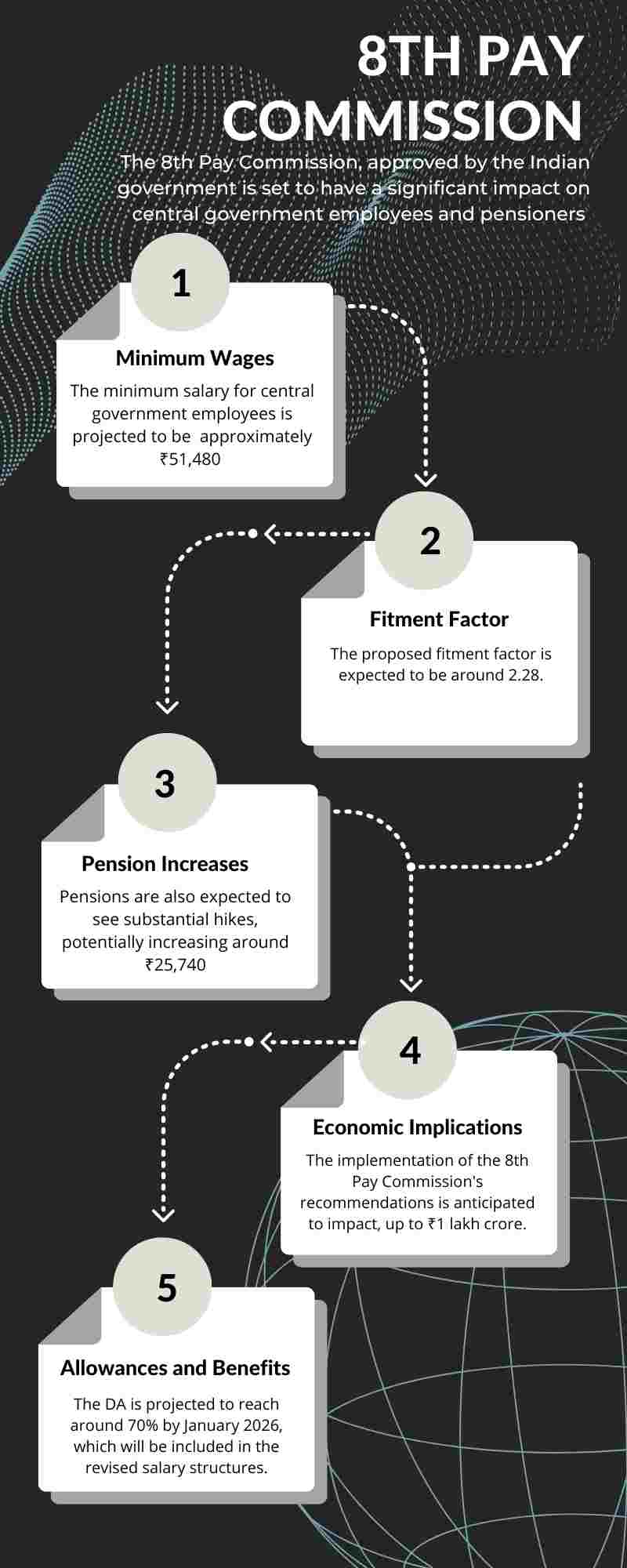

The 8th Pay Commission, approved by the Indian government on January 16, 2025, is set to have a significant impact on central government employees and pensioners when its recommendations are implemented in 2026. Here are the key expectations and potential effects:

Expected Salary Increases

- Minimum Salary: The minimum salary for central government employees is projected to rise from ₹18,000 to approximately ₹41,000, with some estimates suggesting it could go as high as ₹51,480 if a fitment factor of 2.86 is approved. This represents a potential increase of up to 186% compared to current salaries.

- Fitment Factor: The proposed fitment factor is expected to be around 2.28, which would result in a 34.1% increase in the minimum wage. However, discussions are ongoing about a higher fitment factor that could further boost salaries.

Pension Revisions

- Pension Increases: Pensions are also expected to see substantial hikes, potentially increasing from ₹9,000 to around ₹25,740 if the higher fitment factor is adopted. This increase aims to enhance the financial security of retirees.

Impact on Employees and Pensioners

- Beneficiaries: Approximately 50 lakh central government employees and 65 lakh pensioners will benefit from these changes. This includes personnel from various ministries, departments, and defence forces.

- Economic Implications: The implementation of the 8th Pay Commission's recommendations is anticipated to have a significant economic impact, similar to the previous commission, which resulted in a ₹1 lakh crore increase in salary and pension payouts in its first year.

This surge in disposable income is expected to enhance purchasing power among employees and pensioners.

Allowances and Benefits

- Dearness Allowance (DA): The DA is projected to reach around 70% by January 2026, which will be included in the revised salary structures. This adjustment aims to help employees cope with inflation and rising living costs.

8th Pay Commission: How Much Will DA and HRA Increase?

As per the recommendations of the latest Pay Commission, the House Rent Allowance (HRA) is revised based on the Dearness Allowance (DA) increase. The revised HRA percentages are as follows:

- Type X cities: 30% of the basic pay

- Type Y cities: 20% of the basic pay

- Type Z cities: 10% of the basic pay

Example Calculation: For an employee with a basic pay of ₹40,000:

- Type X city: ₹12,000

- Type Y city: ₹8,000

- Type Z city: ₹4,000

8th Pay Commission: Other Allowances That May Increase

- Children's Education Allowance

- Special Allowance for Childcare

- Hostel Subsidy

- Transport Allowance on Transfer

- Gratuity Ceiling

- Dress Allowance

- Mileage Allowance for Own Transport

- Daily Allowance

8th vs. 7th Pay Commission: Key Difference Explained Between 7th and 8th Pay Commission's Other Allowances

| Allowance Type | 7th Pay Commission | 8th Pay Commission (Expected) |

| House Rent Allowance (HRA) | Paid at rates of 24%, 16%, and 8% of basic pay based on city classification (X, Y, Z cities). | Anticipated to be revised further; potentially higher rates reflecting current housing market trends. |

| Dearness Allowance (DA) | Adjusted periodically; linked to the Consumer Price Index (CPI) with a current rate of 28% as of July 2024. | Expected recalibration to accommodate inflation; could rise significantly, potentially exceeding 35%. |

| Transport Allowance (TA) | Revised to align with new pay scales; varies based on pay level. | Likely to see increases to better match rising commuting costs; specific percentage increases are yet to be announced. |

| Children Education Allowance | Introduced with a limit of ₹2,250 per child per month for up to two children. | Expected enhancement in limits due to rising education costs; potential increase to ₹3,000 or more per child. |

| Risk and Hardship Allowances | Included various categories with specific rates for hazardous duties. | Anticipated review and possible increases for high-risk jobs, reflecting current conditions and demands. |

| Accidental Allowance | Included as part of revised allowances; specifics not widely detailed. | May see enhancements or new provisions for accident-related compensation, reflecting increased awareness of employee safety. |

| Outstation Detention Allowance | Revised for employees travelling away from their base location. | Anticipated adjustments based on current travel-related expenses and market conditions. |

| Trip Allowance | Revised based on travel frequency and distance; specifics vary by department. | Expected updates based on current travel norms and employee feedback. |

| Ghat Allowance | Included for employees working in hilly areas; specifics not widely detailed. | Likely to continue with possible adjustments based on living conditions in such areas. |

| Special Train Controllers Allowance | Introduced for specific railway staff, with varying rates. | May see revisions or new allowances for specialised roles in transport services. |

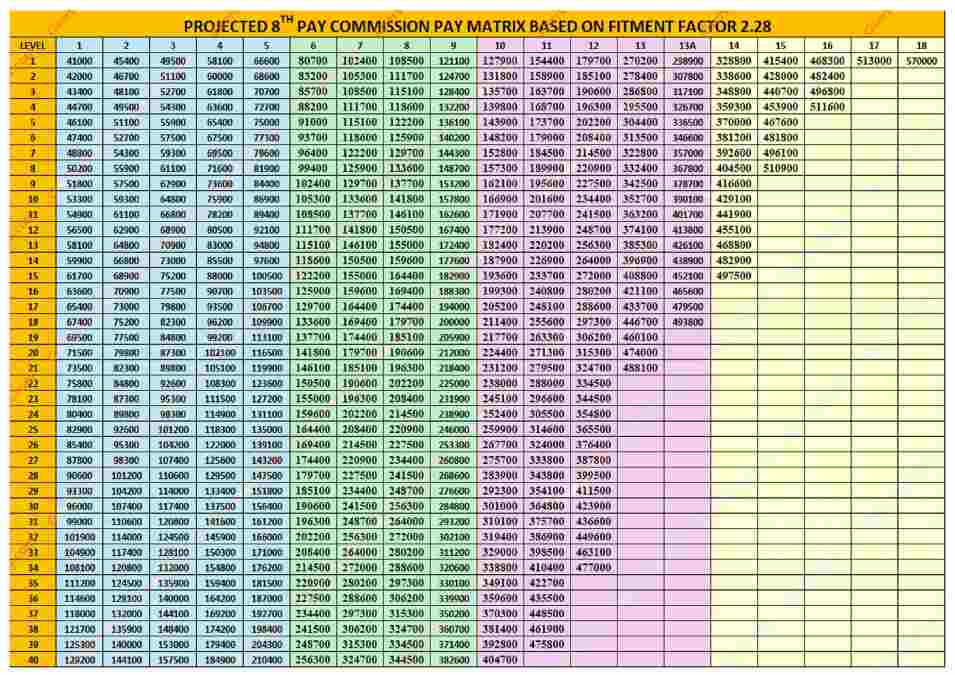

8th Pay Commission: What is Pay Matrix Table? How Does it Work?

The Pay Matrix Table is a simple chart introduced by the government to calculate salaries for employees based on their pay level and years of service. It was introduced to make salary structures easier to understand and ensure uniformity across various government departments.

How Does It Work?

-

Pay Levels:

- Each job or rank is assigned a specific pay level in the matrix (e.g., Level 1, Level 2, up to Level 18 or more).

- Higher levels correspond to higher-ranking positions.

-

Pay Bands and Index:

- Each pay level has a range of salaries (called a pay band) that increase with experience or years of service.

- The index within a pay level shows how much salary an employee will earn based on their experience.

-

Basic Pay:

- Your salary starts with a basic pay, which is the amount fixed by your pay level and index.

- This basic pay is used to calculate allowances like HRA (House Rent Allowance), DA (Dearness Allowance), and others.

Example (Simplified)

Imagine a Pay Matrix Table for Level 1 (Entry-level job):

| Index (Years of Service) | Pay (₹) |

|---|---|

| 1 (Starting) | ₹18,000 |

| 2 (After 1 year) | ₹18,500 |

| 3 (After 2 years) | ₹19,000 |

If you join a Level 1 position, your starting salary is ₹18,000. After completing one year, it increases to ₹18,500 and so on.

How Is Salary Calculated?

-

Find Your Basic Pay: Check your pay level and index in the matrix.

-

Add Allowances:

- DA: A percentage of basic pay (e.g., 50% DA means ₹18,000 × 50% = ₹9,000).

- HRA: Based on city category (e.g., 20% of ₹18,000 for a Type Y city = ₹3,600).

- Other allowances like travel, education, etc., are also added.

-

Total Salary: Add the basic pay and all allowances to get your gross salary.

8th Pay Commission: What is the Projected Salary for Different Govt. Employees?

All Levels in the Pay Matrix Use a Uniform Multiplication Factor of 2.28. The Pay Matrix introduced in the 7th Pay Commission is designed to be simple and clear. It has 19 levels, replacing the 19 grades from the 6th Pay Commission.

Salaries in all these levels are calculated using the same multiplying factor of 2.28, making the process uniform for everyone.

The newly designed pay matrix is considered highly user-friendly and provides greater transparency in salary structures. Given its simplicity and efficiency, it is anticipated that the 8th Pay Commission might continue using this format for future pay revisions.

However, there is always the possibility that the 8th Pay Commission could introduce changes, resulting in a pay matrix format different from the one used in the 7th CPC.

Source: gservants

8th Pay Commission: When Will the Benefits Be Implemented for Central Government Employees?

The 7th Pay Commission took about 22 months to implement its recommendations after it was formed.

The government recently approved the creation of the 8th Pay Commission to review and revise the salaries and allowances of nearly 50 lakh central government employees and 65 lakh pensioners. While this decision has raised hopes, the government has not yet announced a timeline for setting up the commission or implementing its recommendations.

This leads to the question: how long will it take for employees to see the benefits of the 8th Pay Commission?

The 7th Pay Commision was set up in February 2014, submitted its recommendations by November 2015, and these were implemented in January 2016, taking a total of 22 months or in other words 2 years.

If the 8th Pay Commission follows a similar timeline, the government employees may have to wait around two years after its formation for revised salaries and benefits. However, there is currently no official announcement on when the commission will be formed.

According to Union MinisterAshwini Vaishnaw, he announced that the recommendations of 7th Pay Commission are effective till 2026. Since 7th Pay Commission will complete its 10 years, the recommendations of the 8th Pay Commission may implement in 2026.

How the Pay Commission Works

Setting up and operating a Pay Commission involves multiple steps that take time.

For example, the 7th Pay Commission was chaired by Retired Justice Ashok Kumar Mathur, with members Vivek Rae, Dr. Rathin Roy, and Secretary Meena Agarwal. Their tasks included consulting with stakeholders, gathering data, and analyzing existing pay structures.

The process includes:

- Extensive meetings with employee groups, experts, and public service commissions of other countries.

- Preparing a report with recommendations on salaries, allowances, and pensions after thorough analysis.

The 7th Pay Commission held over 76 meetings before submitting its report. Once the report is ready, it is reviewed by the government, particularly the Finance Ministry. After approval, the recommendations are implemented through resolutions issued by the Ministry of Finance.

Implementing a Pay Commission's recommendations also has financial implications. For instance, the 7th Pay Commission’s recommendations led to an estimated additional cost of ₹1,02,100 crore for FY 2016-17. While salaries and pensions were revised from January 1, 2016, updated allowances took effect from July 1, 2017, based on further recommendations by a panel.

Comments

All Comments (0)

Join the conversation