One of the most frequently used terms in everyday life is the term ATM and the machine is used almost daily. Whether it is drawing out cash, checking a balance or just moving money, the ATMs have become an inalienable aspect of the new banking system. However, even though they are used so much by people, not everyone is aware of what is the full form of ATM and how it came into existence. Knowing its complete form and history does not only increase your knowledge, but also makes you appreciate the fact that this machine changed how money is handled.

What is the Full Form of ATM?

The full form of ATM is “Automated Teller Machine.” It is an automated banking device that enables the customers to carry out banking transactions by depositing, withdrawing cash, transferring funds, and checking the balance without any human help. Automated is used because the process is conducted automatically by the machine and Teller is used because the tasks are traditionally done by a bank official serving customers at a counter. Therefore, the Automated Teller Machine is the most appropriate name given to this machine that is being used to carry out the functions of a human teller in an automated manner.

According to the Kotak Mahindra Bank, it is the right and officially recognized full name of the ATM. There are also those who confuse the full form of an ATM as Any Time Money, yet it is just a popular catchphrase that has caught on with the general public. An ATM is meant to facilitate 24/7, easy, convenient banking so that any customer can access their money at any time. Nowadays, ATMs are fitted with high-level security software, card readers and digital interfaces, thus enabling users to use them safely and efficiently to carry out various functions.

When Were ATMs Introduced?

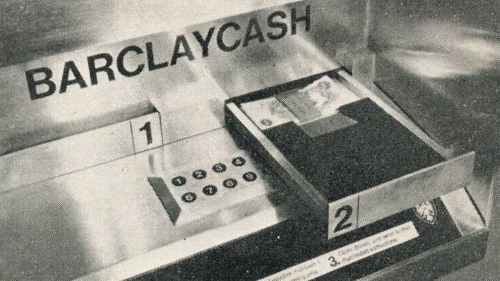

Source: Barclays

The ATM idea was first discovered in the 1960s when Barclays Bank launched the ATM on 27 June 1967 in Enfield London branch of Barclays. This brought about a revolution in world banking. John Shepherd-Barron had an idea of how to make a customer get their money even after the banking hours, and he invented this machine.

When Were ATMs Introduced in the USA?

Source: History of Information

The American Banker reports that the first ATM in the United States was installed on 2 September 1969 in Rockville Centre, New York, by Chemical Bank. The incorporation of ATMs became common all over the world and in the coming decades, the banks adopted it as part of the convenience of the customers.

When Were ATMs Introduced in India?

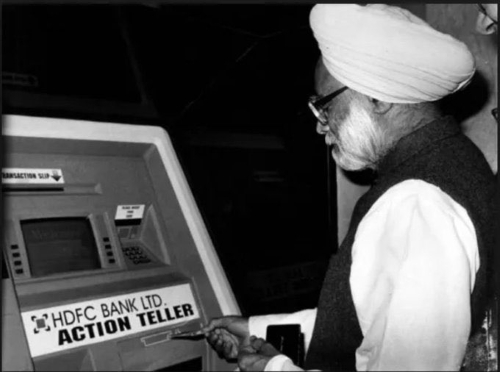

Source: Congress Kerala on X

According to the Economic and Political Weekly Research Foundation, the first ATM was installed in 1987 in HSBC bank in their Mumbai branch, India. As reported by the Reserve Bank of India (RBI), the country has more than 2 lakh ATMs today due to which millions of customers access their services on a daily basis.

What Are the Most Important ATM functions?

At present ATMs (Automated Teller Machines) provides the user with the opportunity to:

-

Take out cash in a bank account with a debit or ATM card and PIN.

-

Request mini-statements and check account balance.

-

Withdraw funds or checks (at the advanced machines) without going to the bank counter.

-

Move money between accounts, settle a few bills or switch PINs (depending on machine/country).

-

Operate 24 x 7 (whereas in most instances) and be situated in banks, malls, airports, etc, making it more convenient.

In conclusion, the Automated Teller Machine (ATM) was indeed among the most significant inventions in the history of banking. What initially started as a simple concept to get money outside the banking hours has now become a global chain of intelligent machines that can easily conduct various banking processes.

Comments

All Comments (0)

Join the conversation