Admission of a Partner Class 12 Notes: Here, students can find Admission of a Partner Class 12 revision notes. This CBSE Admission of a Partner class 12 short notes have been prepared by our subject experts in accordance with the updated and revised CBSE Syllabus 2024. Students can also find the Admission of a Partner class 12 notes pdf download link at the bottom of the article.

Admission of a Partner class 12 handwritten notes have been prepared after a detailed analysis of the chapter and refinement of all the essential information only. It is a summary of the chapter with all the important topics, definitions, formulas, and journal entries. Class 12 Accountancy Chapter 2 notes will help you clarify your doubts regarding the chapter and will guide you in understanding which topic is important from the exam’s point of view.

Related:

CBSE Class 12 Accountancy Syllabus 2023-2024

CBSE Class 12 Accountancy MCQs

NCERT Solutions for Class 12 Accountancy

CBSE Class 12 Accountancy Chapter 2 Mind Maps

Reconstitution of a Firm- Admission of a Partner Class 12 Revision Notes

Admission of a Partner class 12 notes are presented here for your reference. Use the PDF download link attached below to save the revision notes for future use. Check the detailed revision notes here.

What are the modes of reconstitution of a partnership firm?

Under the following circumstances, a partnership firm is reconstituted.

- Admission of a new partner

- Change in the profit-sharing ratio among the existing partners

- Retirement of an existing partner

- Death of a partner

Here, the admission of a partner will be discussed in detail

Rights acquired by newly admitted partner

Rights acquired by a newly admitted partner are:

- Right to share the assets of the partnership firm

- Right to share the profits of the partnership

Things to be considered at the time of admission of a partner

The following things are to be considered at the time of admission of a partner:

- Newprofit sharing ratio;

- Sacrificing ratio;

- Valuation and adjustment of goodwill;

- Revaluation of assets and Reassessment of liabilities;

- Distribution of accumulated profits (reserves); and

- Adjustment of partners’

New Profit Sharing Ratio

On the admission of a new partner, the old partners sacrifice a share of their profit in favor of the new partner. But, what will be the share of the new partner and how he will acquire it from the existing partners is decided mutually among the old partners and the new partner. However, if nothing is specified as to how the new partner acquires his share from the old partners; it may be assumed that he gets it from them in their profit-sharing ratio. The profit-sharing ratio among the old partners will change keeping in view their respective contribution to the profit-sharing ratio of the incoming partner. Hence, a new profit-sharing ratio has to be adopted.

What is Sacrificing Ratio?

The ratio in which the old partners agree to sacrifice their share of profit in favor of the incoming partner is called sacrificing ratio.

Mathematically,

Sacrificing Ratio = Old share of profit- New share of profit

What is Goodwill?

Over a period of time, a well-established business develops the advantage of a good name, reputation, and wide business connections. This helps the business to earn more profits as compared to a newly set up business. In accounting, the monetary value of such an advantage is known as “goodwill”. It is an intangible asset. In other words, goodwill is the value of the reputation of a firm with respect to the profits expected in the future over and above the normal profits.

Factors affecting the value of Goodwill

The factors affecting the value of goodwill are:

- Nature of business - A business creates a positive impact and adds some changes to society, their goodwill increases naturally.

- Location - If the business is centrally located or is in a place having heavy customer traffic, the goodwill tends to be

- Efficiency of Management- Effective management results in high productivity and cost efficiency, which ultimately brings profit and hence goodwill to the company.

- Market Situation- If you have a monopoly in the market or less competition, the tendency of more profit and hence more goodwill increases.

- Special Advantages-Business have advantages like import licenses, low rates and assured supply of electricity, long-term contracts for supply of materials, well-known collaborators, patents, trademarks, enjoy higher value of goodwill.

Need for valuation of Goodwill

The need for the valuation of goodwill exists under the following circumstances:

- Change in the profit sharing ratio amongst the existing partners;

- Admission of new partner;

- Retirement of a partner;

- Death of a partner; and

- Dissolution of a firm involving the sale of business as a going

- Amalgamation of partnership

Methods of valuation of Goodwill

Methods of valuation of goodwill are as follows:

- AverageProfits Method- Under this method, the goodwill is valued at an agreed number of ‘years’ purchases of the average profits of the past few years. It is based on the assumption that a new business will not be able to earn any profits during the first few years of its Hence, the person who purchases a running business must pay in the form of goodwill a sum which is equal to the profits he is likely to receive for the first few years. The goodwill, therefore, should be calculated by multiplying the past average profits by the number of years during which the anticipated profits are expected to accrue.

- SuperProfits Method- Under this method, the value of goodwill is calculated on the basis of excess profits instead of actual profits, since it is contended that the buyer’s real benefit does not lie in total profits; it is limited to such amounts of profits which are in excess of the normal return on capital employed in similar business.

Mathematically,

3. CapitalisationMethod- Under this method, the goodwill is calculated on the basis of two ways:

(a) Capitalisation of Average Profits- Under this method, the value of goodwill is ascertained by deducting the actual firm’s capital in the business from the capitalized value of the average profits on the basis of the normal rate of return. This involves the following steps:

- Ascertain the average profits based on the past few years

- Capitalize the average profits on the basis of the normal rate of return to ascertain the capitalized value of average profits as follows: Average Profits 100/Normal Rate of Return

- Ascertain the actual firm’s capital (net assets) by deducting outside liabilities from the total assets (excluding goodwill and fictitious assets). Firms’ Capital = Total Assets (excluding goodwill) – Outside Liabilities Where outside Liabilities include both long-term and short-term Liabilities.

- Compute the value of goodwill by deducting net assets from the capitalized value of average profits, e.g. (ii) – (iii).

(b) Capitalisation by Super Profits- Goodwill can also be ascertained by capitalizing the super profit directly. Under this method, there is no need to work out the capitalised value of average profits. It involves the following steps.

- Calculate the capital of the firm, which is equal to total assets (excluding goodwill and fictitious assets) minus outside liabilities.

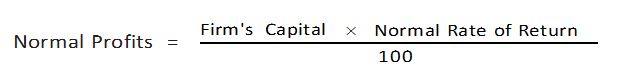

- Calculate normal profits on capital

- Calculate the average profit for past years, as

- Calculatesuper profits by deducting normal profits from the average

- Multiply the super profits by the required rate of return multiplier, that is,

Goodwill = Super Profits 100 Normal Rate of Return

To download the complete Revision Notes for CBSE Class 12 Reconstitution of a Partnership Firm – Admission of a Partner, click on the link below

Comments

All Comments (0)

Join the conversation