Profit and Loss: Understanding profit and loss is essential in economics and accounting. This article aims to explore various essential elements related to profit and loss, including concepts such as cost price, fixed costs (which remain constant regardless of production levels), variable costs (which fluctuate with production volume), and semi-variable costs (which have both fixed and variable components). Additionally, it will cover terms like selling price, marked price, list price, and margin. By examining these concepts and formulas related to profit and loss, readers can gain a comprehensive understanding of how businesses calculate and manage their financial outcomes.

Profit

If the selling price (S.P.) of an article/product is greater than the cost price (C.P.), the difference between the selling price and cost price is called profit. Thus, if S.P. > C.P., then

Profit = S.P. – C.P.

S.P.= C.P. + Profit

C.P.= S.P. – Profit

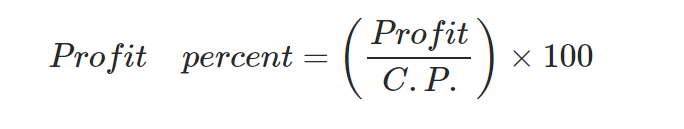

Profit Percentage

The profit percent is the profit that would be obtained for a C.P. of Rs 100 i.e,

Loss

If the selling price (S.P.) of an article/product is less than the cost price (C.P), the difference between the cost price (C.P.) and the selling price (S.P.) is called loss. Thus, if S.P. < C.P., then

Loss = C.P. – S.P.

C.P. = S.P. + Loss

S.P. = C.P. – Loss

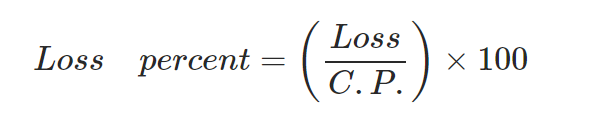

Loss percentage

The loss percentage is the loss that would be made for a C.P. of Rs 100, that is

![]() Neutral Situation

Neutral Situation

If S.P. = C.P., then the seller neither gains money or loses any.

Concepts, Definition and Formula

Cost Price: The amount paid to buy an article or the price at which an article/product is made is known as cost price. The cost price is abbreviated as C.P.

Selling Price: The price at which an article is sold is known as selling price. The selling price is abbreviated as S.P.

List Price: The list price, also known as the Manufacturer’s Suggested Retail Price (MSRP), Recommended Retail Price (RRP), or Suggested Retail Price (SRP), is the price set by the manufacturer for a product. It's the price they suggest retailers sell the product for. On the other hand, the Maximum Retail Price (MRP) is the highest price at which the product can legally be sold to consumers. It's designed to ensure consumers don't pay more than this price when buying the product.

Fixed Cost: Fixed costs are expenses that remain the same no matter how much a business produces or sells in the short term. These costs are essential for basic business operations and don't change quickly. They directly affect how much it costs to make a product and ultimately impact whether a business makes a profit or a loss.

Variable Cost: If a business produces more items or provides more services, variable costs increase. If production decreases, these costs go down. They directly follow the ups and downs of production levels. For instance, costs like raw materials and labor rise or fall based on how many products are being made or services delivered.

Semi-Variable Cost: A semi-variable cost includes both parts of fixed and variable. It stays the same up to a certain production level, like a fixed cost. However, beyond this level, it changes along with production, like a variable cost. Think of it as a cost that has a basic, steady part (fixed) and an additional part that fluctuates based on how much a business produces (variable). This type of cost has elements of both stability and change depending on production levels.

Marked Price: Marked Price (MP) is the price you see on the label of a product when you go shopping. It's the price set by the seller for the product. Sometimes, the actual selling price might be lower than the marked price because of discounts or promotions offered by the seller.

When a discount is offered, M.P. > S.P.

When a discount is not offered, M.P. < S.P.

Margin: Understanding margin helps businesses see how much profit they're making from sales, while markup helps set prices based on cost and desired profit. Both are crucial for business planning and pricing strategies.

Comments

All Comments (0)

Join the conversation