The Indian government has introduced a major change in gratuity rules as a part of the new labour codes from November 21, 2025. These updated Labour Codes 2025 have brought one of the biggest reforms in social security, particularly in gratuity provisions.

Do you know these laws comes with major benefits like gratuity ,recognition of gig economy workers, and more. You must learn about how Fixed-term and contract employees can now qualify for gratuity after just one year of service, compared with five years previously. This move aims to strengthen worker benefits, encourage formal employment, and reduce over-reliance on contractual jobs. Through this article, understand a breakdown of the key changes and their impact on employees.

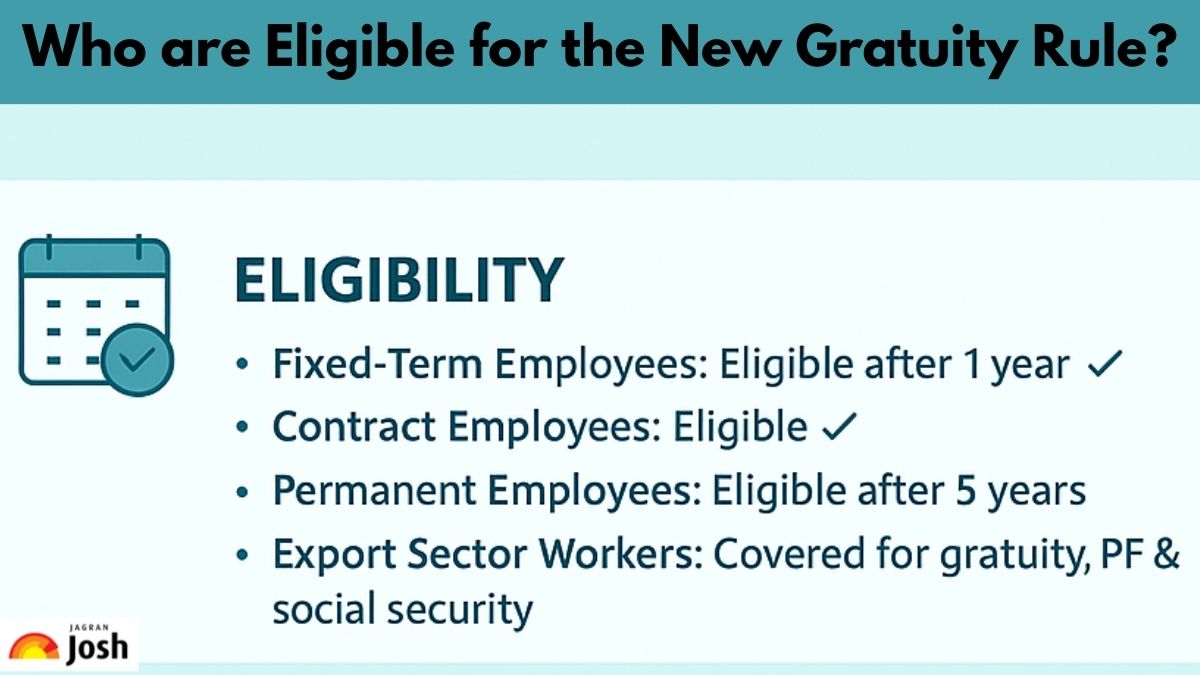

Who Is Eligible for Gratuity Under New Rules?

The new rules expand gratuity coverage to include fixed-term and contract employees, as well as workers in the export sector. Key eligibility changes includes:

-

Fixed-term employees: Eligible after 1 year of continuous service (previously 5 years). Must complete at least 240 days in the year.

-

Contract employees: Now entitled to gratuity like permanent staff.

-

Export sector fixed-term workers: Covered for gratuity, PF, and other social security benefits.

Note: The 5-year rule still applies for permanent employees.

How Will Gratuity be Payable?

Gratuity will be payable when an employee retires, resigns, or in case of death or disability. If the employee has nominated someone, the gratuity will go to the nominee; otherwise, it will go to the heirs. For minors, the amount will be deposited with the controlling authority for safe investment.

What is the Gratuity Calculation?

Gratuity is calculated based on the Payment of Gratuity Act, 1972. The updated rules expand the wage definition, which may increase payouts.

| Parameter | Details |

| Formula | Last drawn basic salary × 15/26 × completed years of service |

| Maximum Payout | ₹20 lakh |

| Components | Basic salary + Dearness Allowance (DA) |

| Tax Status | Fully tax-free |

| Payment Timeline | Within 30 days of resignation/retirement, a 10% annual interest penalty for delay |

Key Points:

-

15 is the number of days in a month (as per labour laws)

-

26 is the average number of working days in a month

-

Wages now must form at least 50% of total compensation, raising the gratuity base.

-

Pro-rata payouts apply to fixed-term employees based on contract length.

Also Read, 12 major new labour law changes, everyone must know!

Fixed-Term vs Permanent Employees

As far as the Fixed-term contracts are concerned, have a predetermined end date, linked to a project or assignment. They are eligible for gratuity after 1 year.

However, Permanent employees, can continue to follow the 5-year rule. Both categories must be treated equally during employment for wages and benefits.

What are the Benefits for Fixed-Term Employees?

Fixed-term employees will now enjoy similar salary, leave, medical, and social security benefits as regular employees such as:

-

Financial security after short-term employment

-

Statutory parity with permanent employees

-

Transparent terms of employment with mandatory appointment letters

How Will This Impact the Employers?

Employers as per the new rule can do direct hiring and more formal employment. They will need to update payroll systems to account for the expanded wage definition, and they must adjust internal policies to comply with new requirements:

-

Update salary structures to reflect expanded wage definition

-

Release gratuity within 30 days to avoid penalties

-

Provide gratuity, PF, and social security coverage to fixed-term and contract workers

-

Monitor compliance across sectors, including export industries

Key Additional Changes Under Labour Codes 2025

Gratuity Update 2025: Fixed-term employees can now claim gratuity after 1 year of service. Expanded wage definitions mean higher payouts, and employers must pay within 30 days or face 10% annual interest. Other than this major key changes include the following:

-

ESIC healthcare coverage expanded to 740 districts

-

Minimum wage protections extended across sectors

-

Mandatory health checkups for employees above 40

-

Streamlined labour laws replacing 29 legacy acts

Therefore, to conclude, the New Gratuity Rules 2025 mark a significant step in ensuring equitable social security for all workers, especially fixed-term and contract employees. With the qualifying period reduced to one year and wages redefined, employees gain stronger financial security, while organisations must strengthen compliance and transparency.

Comments

All Comments (0)

Join the conversation