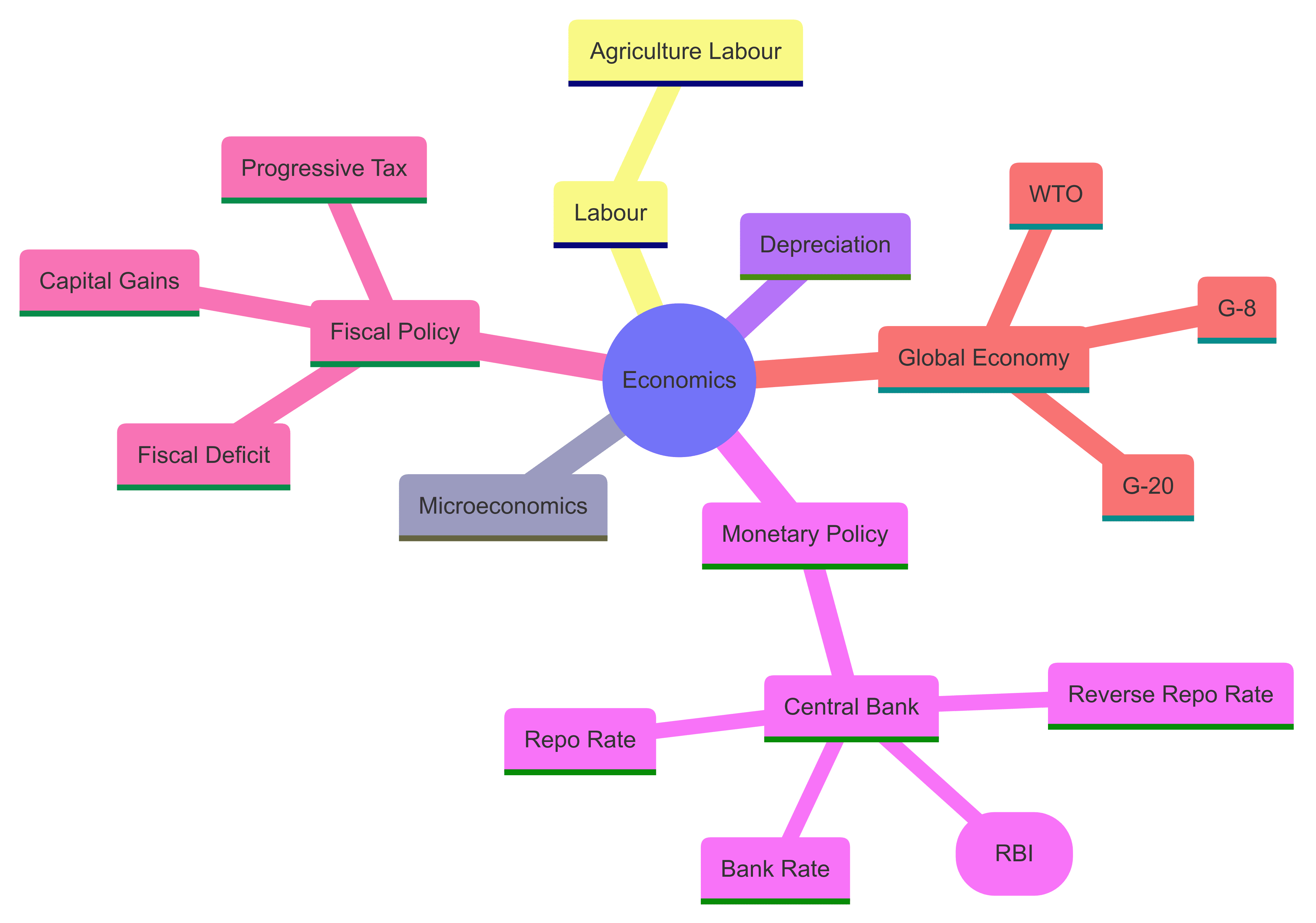

Indian Economy NCERT Notes for UPSC: It's not easy to prepare for the UPSC exam, particularly when it comes to preparing for the Indian economy. The subject is crucial for both the preliminary and major exams, requiring extensive knowledge of different Economic Concepts like liberalisation, privatisation, and globalisation and many important policies like fiscal and monetary policies, etc. The Indian economy subject will also include subjects such as the role of Reserve Bank of India (RBI), banking system in India, structure of Indian tax system, role of World Trade Organisation (WTO), World Bank, etc.

Attempt UPSC CSE Mock Test for based on Latest Exam Pattern

NCERT books are an invaluable tool for candidates, as they provide a solid foundation and are full of easily accessible material. This article will examine the importance of NCERT notes, highlight important economic concepts that are included in these books, and give recommendations on how to use them to your advantage when preparing for the UPSC.

Also Check,

Indian Economy NCERT Notes for UPSC

NCERT books are often considered the bible for UPSC preparation. This book offers a clear and concise explanation of complex topics, which makes it easier for candidates to grasp fundamental concepts. The language used in these books is straightforward and well structured, which further helps in building a strong base.

It is crucial to understand the basics of each topic before diving into the advanced level. NCERT books from classes 9 to 12 provide a wide range of topics on the Indian economy that are suitable for the UPSC exam. Gaining competence in these foundations will prepare you to handle more challenging subjects and questions.

NCERT books provide comprehensive coverage of various economic concepts. These books provide comprehensive details of various economic policies that are essential for UPSC aspirants. Let us see some of the important topics and their definitions as per NCERT.

Microeconomics: It is the branch of economics that deals with the choice and decision making process by individual units such as consumer, firms, industry, etc. In microeconomics, we study the behaviour of individual economic agents in the market for different goods and services and try to figure out how the prices and quantities of goods and services are determined through the interaction of agents in the market.

Agriculture Labour: A person who earns a major part of their income from work performed on the farms of others. An agricultural labourer gets wages in money and/or in kind. The mode of employment and the systems of payments to agricultural labour are extremely diverse. The labourers may also suffer from various forms of bondage, especially as a result of indebtedness.

Depreciation: Reduction in the value of a capital asset through normal wear and tear and expected obsolescence. It is also known as the consumption of fixed capital or the replacement cost of capital.

Depreciation = Gross Investment - Net Investment

Monetary Policy: The policy of the central bank of the country (such as the Reserve Bank of India) aimed at controlling the money supply/credit in the country with a view to achieve the desired policy objectives such as, control of inflation, higher rate of growth, correcting the unfavourable balance of payments, employment generation, etc. The central bank uses instruments like bank rate, cash reserve ratio (CRR), statutory liquidity ratio (SLR), open market operations, etc. to implement the money policy

Central Bank: The apex monetary institution of a country. It issues currency, controls credit, and acts as the banker to the government and the other banks. It also acts as a lender of last resort to commercial banks. Reserve Bank of India is the Central Bank of India, and the Federal Reserve System is the Central Bank of the United States

Reserve Bank of India (RBI): India's Central Bank. It was established on April 1, 1935 and nationalised in 1949. The main objective of RBI is to frame and implement monetary policy to ensure price stability, sustainable growth and financial stability. RBI functions as the monetary policy authority and regulator of money, note-issuing authority, and banker to banks and the government. Besides, it regulates and supervises banking and non-banking financial institutions, foreign exchange and government securities markets and overseas payment and settlement systems.

Bank Rate: The rate of interest that a central bank (e.g., the Reserve Bank of India) charges on loans and advances made to commercial banks. In India, it is a rate at which banks are penalised for shortfalls in meeting their cash reserve requirements.

Repo Rate: It stands for repurchase obligation. When commercial banks want short term liquidity, they can keep their securities with the central bank and get the funds. However, they are obliged to buy back these securities at a later date. The consequent rate of interest charged by the central bank is called repo rate. The repo rate is different from the bank rate.

Reverse Repo Rate: It stands for the rate at which commercial banks can put their surplus funds with the central bank temporarily for the short term to buy securities from the central bank.

Fiscal Deficit: The difference between government's total expenditures and total non-debt receipts. The receipts of the government does not include borrowings of the government. Government receipts are divided into two groups revenue receipts and capital receipts. Revenue receipts are receipts from current activities such as tax revenues. As capital receipts affect the asset or liability position, they can either create liabilities (example borrowings) or reduce assets (example disinvestment).

Fiscal Deficit = Total Expenditure - (Revenue Receipt + Non Dept Capital Receipts)

Fiscal Policy: Policy of the government regarding spending, taxation and borrowing. Its objectives include achieving economic growth, price stability, employment generation, and distributive justice. Examples of fiscal policy is leving taxes on public or government spending on public works

Progressive Tax: A tax in which the tax rate increases with an increase in income or expenditure. With increasing income, the rate of tax-liability also increases. Expenditure tax can be made progressive by charging a higher rate for luxury items and a lower for necessities.

An example of progressive tax is where income is exempted from tax for the first Rs. 2 lakhs, and is taxed at the rate of 10 percent on the next Rs. 2 lakhs, 20 percent on the next Rs. 4 lakhs and 30 percent on the rest. It aims to achieve an equitable distribution of income.

Capital Gains: The rise in the value of a capital asset such as land or stocks. The gain is the difference between the sale price and the purchase price of the asset.

G-20: A group of finance ministers and central bank governors from 19 of the world's largest economies, and the European Union. The G-20 was formed in 1999 as a forum for member nations to discuss key issues related to the global economy. The mandate of the G-20 is to promote growth and economic development across the globe. The Group of Twenty consists of the members of the G-7 (France, Germany, Italy, Japan, United Kingdom, United States and Canada), 12 other nations (South Africa, Mexico, Argentina, South Korea, Indonesia, Russia, Turkey, Australia, China, India, Brazil, and Saudi Arabia) and the European Union

G-8: A group consisting of eight of the most economically developed nations in the world, who meet periodically to address international economic and monetary issues. The G-8 includes the Group of Seven countries, along with Russia. Russia, although not a full member, has been in attendance since 1994

WTO: An international body to supervise, promote and regulate international trade. It was set in 1995 and is based in Geneva. The WTO is charged with the development of a multilateral trading system to encourage world trade. The WTO is financed by contributions from its member states based on their shares of international trade.

ASEAN: The association of Southeast Asian Nations which is a geo political and economic organisation of ten countries located in South East Asia. It was formed on August 8, 1967 by Indonesia, Malaysia, the Philippines, Singapore and Thailand. Now five more countries viz. Brunei, Myanmar, Combodia, Laos and Vietnam have also joined this group. ASEAN invites some other Asian countries to attend its meetings as observers

For those preparing for the UPSC, NCERT books are a great resource, particularly for the Indian Economy subject. They offer a strong basis by clearly and simply addressing key topics. Those who comprehend and use these books well might improve their preparation and raise their chances of passing the UPSC examinations.

Read Here: Success Stories and Struggles UPSC 2023 Toppers

Comments

All Comments (0)

Join the conversation