Budget 2024 Summary and UPSC Notes: Budget Day is a highly anticipated event in India, with companies and the general public anxious to learn about the plans and projects that may benefit them. The budget is generally presented by the Finance Minister on February 1, but due to general elections in the country this year, an interim budget was presented on Feb 1 and the full budget is being presented on July 23, 2024.

Attempt UPSC Mock Test based on Latest Exam Pattern

The budget presented every year is like an approval to draw money from the consolidated fund of India. It is the main treasure of the government and all the taxes and non tax revenues are collected here. This fund was constituted under Article 266(1) of the Constitution of India.

Also Check,

The phrase "fiscal deficit" refers to the difference between the government's total revenue and total expenses. It is a representation of the entire amount of borrowing that the government requires. Borrowings are not taken into account when determining the overall revenue.

Click here to download PDF of Budget 2024 Key Takeaways

Budget 2024 Summary, Key Takeaways for UPSC and Other Competitive Exams

In FY 2023–2024, the government aims to cut the budget deficit from 5.63% of GDP to 5.1%. It is uncertain that there would be a major decrease in tax income given the substantial contribution of personal tax to direct tax collections. The Economic Survey for 2024, which was presented to the Lok Sabha on July 22 before the Budget, predicted that India's GDP will expand by 6.5–7% in 2025, less than the 8.2% growth rate predicted for the previous year. Here are Key takeaways from the budget 2024 for UPSC and other competitive exams

Budget 2024 is based on 4 factors — Employment, skilling, MSMEs and middle class, says Sitharaman. India's inflation rate is still low, steady, and approaching the 4% objective, says minister Nirmala Sitharaman.

There Nine Budget Priorities in pursuit of ‘Viksit Bharat’:

- Productivity and resilience in Agriculture

- Employment & Skilling

- Inclusive Human Resource Development and Social Justice

- Manufacturing & Services

- Urban Development

- Energy Security

- Infrastructure

- Innovation, Research & Development

- Next Generation Reforms

Financial support has been announced for flood-affected states. Check the states and alloted amount below

Bihar: ₹11,500 crore to address flood control structure delays in Nepal

Assam: Aid for flood management and related projects

Himachal Pradesh: Multilateral assistance for reconstruction after extensive flood damage

Uttarakhand: Necessary aid for landslide and cloudburst damage

Angel Tax Abolished Government will review Income Tax Act of 1961 in six months

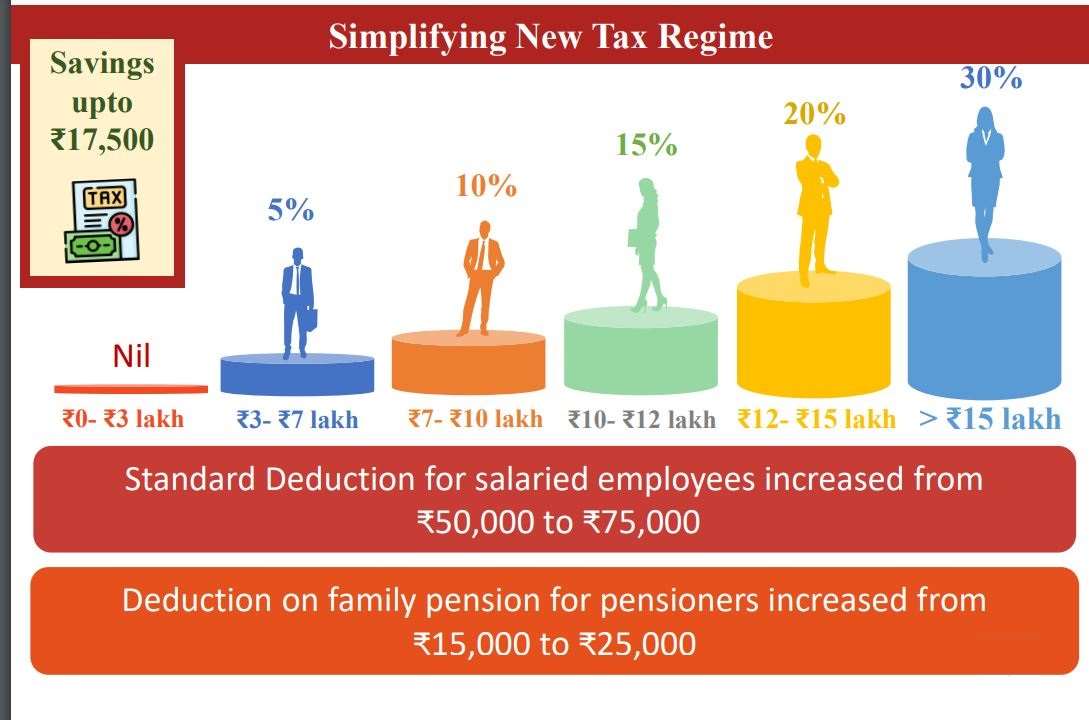

Tax Slab has been revised for New Regime. Check the updated regime below

Standard deduction for salaried employees increased from ₹50,000 to ₹75,000.

Deduction on family pension for pensioners enhanced from ₹15,000/- to ₹25,000/-

- Income up to ₹3 lakh: Tax-free

- Income between ₹3-7 lakh: 5% tax rate

- Income between ₹7-10 lakh: 10% tax rate

- Income between ₹10-12 lakh: 15% tax rate

- Income between ₹12-15 lakh: 20% tax rate

- Income above ₹15 lakh: 30% tax rate

FM has announced Credit Guarantee Scheme to enhance finance access for MSMEs

The government will launch a internship program which offers opportunities to 1 crore (10 million) youth in India's top 500 companies which includes the internship allowance for Rs 5000 during the internship period and Rs 6000 to cover additional costs associated with the internship

Government will reimburse EPFO contributions of employersup to ₹3000 per month for 2 years for all new hires.

Nine Budget Priorities in pursuit of ‘Viksit Bharat’:

- Productivity and resilience in Agriculture

- Employment & Skilling

- Inclusive Human Resource Development and Social Justice

- Manufacturing & Services

- Urban Development

- Energy Security Infrastructure

- Innovation, Research & Development and

- Next Generation Reforms

Medicines and Medical Equipment

- Three cancer drugs namely Trastuzumab Deruxtecan, Osimertinib and Durvalumab fully exempted from custom duty.

- Changes in Basic Customs Duty (BCD) on x-ray tubes & flat panel detectors for use in medical x-ray machines under the Phased Manufacturing Programme.

PM Awas Yojana Urban 2.0 - Needs of 1 crore urban poor and middle-class families will be addressed with an investment of ₹10 lakh crore

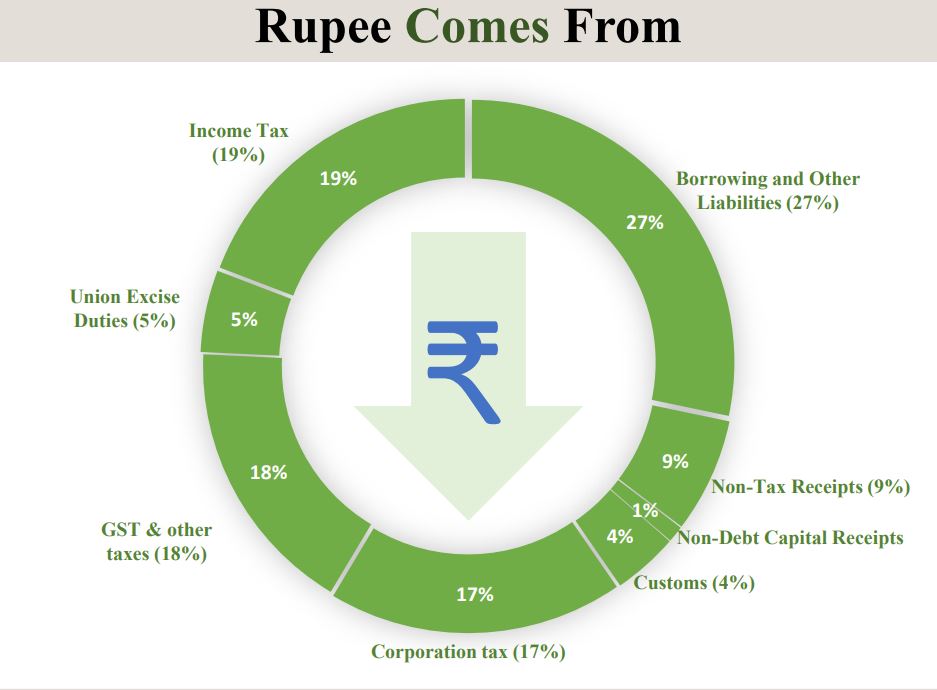

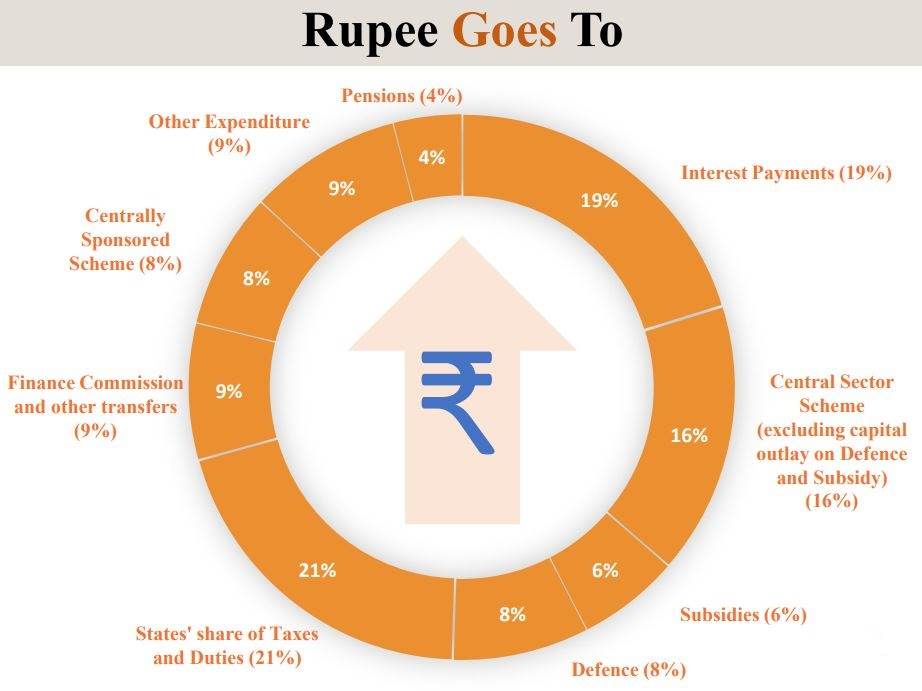

Check the chart below to know about form where government will earn money and where its is going to invest

Also Read,

Allocation of Amount in Different Schemes 2024

In 2024 Government has a plan to invest in many which schemes. . This year MNREGA has received 43% more amount as compared to the previous year. Check the table to know about the allocated amount in different schemes

| Name of Scheme | Allocated Amount (2023-24) in Crores | Allocated Amount (2024-25) in Crores |

| MNREGA | 60000 | 86000 |

| Research and Development Projects | 840 | 1200 |

| Nuclear Power Projects | 442 | 2228 |

| Development of Semiconductors and Display Manufacturing | 3000 | 6903 |

| Solar Power (Grid) | 4970 | 10000 |

| Direct Benefit Transfer- LPG | 180 | 15000 |

| Lines of Credit under IDEA Scheme | 1300 | 3849 |

Comments

All Comments (0)

Join the conversation